A post-mortem on Global Payment's asset swap with FIS

Investor patience is stretched to the limit as Global Payment's search for simplicity is delayed

Disclosure: I am long Global Payments and hold no position in FIS.

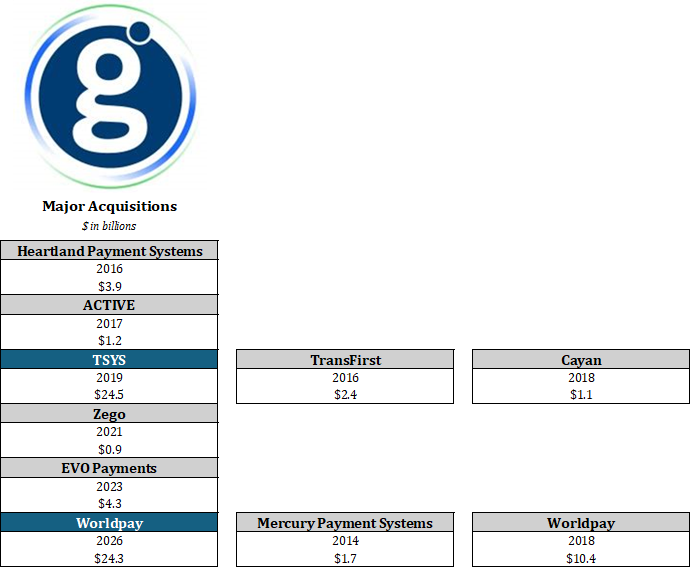

To quickly recap: Global Payments (GPN) is buying Worldpay from Fidelity National Information Services (FIS) and GTCR, a private equity firm, for $24.3 billion and selling Issuer Solutions to FIS for $13.5 billion.

GPN is funding the excess $10.8 billion with debt and approximately 40 million GPN shares valued at $97/share.

By my math, GPN is paying 11.7x EBITDA for Worldpay and selling Issuer Solutions for 12.3x EBITDA. After a tax asset and expense synergies are included, GPN claims a multiple of 8.5x EBITDA for Worldpay.

GPN expects to realize $600 million of expense synergies by year three and for the transactions to be accretive to EPS by a mid-to-high single digit percent after the first year post-close.

GPN’s net leverage at close is expected to be 3.5x, moving down to 3x over 18-24 months.

The market weighs in on the swap and the winner is…not GPN. Shares of GPN fell more than 17% on Thursday while FIS shares rose nearly 9%. Below I push back on some of GPN’s key rationale for the transaction:

Claim: Simplification of business model allows for sharpened strategic focus. GPN is narrowing its focus but not simplifying its business. GPN is bringing together two companies struggling under the weight of complexity from past acquisitions. If history is a lesson, the belief that the combination will improve performance and accelerate growth is misguided.

Claim. Enhanced financial profile. Leverage will go up, again. GPN is selling shares at an unreasonably low price to fund part of the acquisition. Even after including $600 million of expense synergies, the margin profile of the combined company will be lower than standalone GPN.

Claim. Accelerates growth. Worldpay’s current growth rate is unclear. At the time of its acquisition by GTCR, Worldpay was growing slower than GPN. It is unlikely the combination will be accretive to GPN’s Merchant growth rate over the near-term. Further, selling Issuer Solutions eliminates a recurring revenue stream that would partially shield GPN during an economic downturn.

Claim. Diversifies business mix. Selling processing solutions in combination with owned software to SMBs is the sweet spot of merchant acquiring. There was a time when GPN’s M&A efforts were focused on this. Although it is true GPN is diversifying its business with Worldpay, they are entering and deepening exposure to less attractive areas: enterprise merchants and partnered software.

Why I’m (still) long the stock and bought more Thursday. My thesis remains that legacy payments companies are severely mispriced by the market, assuming the worst-case as opposed to a more likely scenario of mid-single digit organic revenue growth, stable and high margins, significant free cash flow, and generous shareholder returns. Companies as I just described fetch attractive valuations, certainly better than what GPN is being afforded currently. I do not believe GPN’s mistakes, including its acquisition of Worldpay, will be fatal. I do believe there are good parts of both GPN and Worldpay that are underappreciated. I am not under the illusion that things will turn around quickly. But I do believe there is significant value here and am willing to wait for it to be unlocked. I may be wrong. And my patience is wearing thin.