Long Intuit

The ultimate SMB platform

Actions

I have raised my position in Intuit to 120 shares from less than 50 shares at the end of last year, with most of those purchases taking place in the past two weeks.

Investment Brief

Shares of Intuit have fallen on concerns AI will disrupt software as businesses develop their own or use ‘super’ agents to optimize existing applications, diminishing their value. Declines accelerated over the past couple of weeks after model makers released tools that reportedly complete knowledge-based tasks. Intuit now trades at its lowest valuation in at least the past decade. I believe the market is overreacting and the AI threat to Intuit is overstated:

The cost of failure is high when it comes to preparing, filing and paying taxes. Although TurboTax has long dominated the do-it-yourself (DIY) category, where lower and no-cost options are widely available, it is moving aggressively to disrupt the much larger assisted category where human interaction is required. During the last tax season, TurboTax Live, Intuit’s assisted offering, represented 41% of total TurboTax revenue, growing 47%. To support its TurboTax Live offering, Intuit has opened 600 offices across the U.S., finding a customer is five times more likely to convert knowing there is a human being that can help within 50 miles.

It is unlikely small and mid-sized businesses (SMBs) will be able to affordably develop and maintain their own payroll, human capital management (HCM), and payments software, all of which Intuit offers through its SMB ecosystem, anchored by the QuickBooks accounting suite. A more plausible scenario is AI makes it possible for anyone to develop ‘roughly’ comparable software at lower cost, in less time. However, what general-purpose models likely will not be able to do is create superior software, acquire customers, or rapidly accrue trust with SMBs and their key partners, including CPAs.

Intuit has been incorporating AI into its products for the past several years, demonstrating tangible results, including sustained monetization gains and improved customer retention. Building on this, last summer Intuit released a fleet of AI agents that perform important financial tasks for SMBs and consumers. Most importantly, Intuit holds a significant amount of proprietary data (an average of 625,000 data points per business and 70,000 per consumer), allowing Intuit to create the best products and experiences for its customers, in my opinion.

Putting AI concerns, and opportunities, aside, Intuit has many attractive qualities: its solutions are mission-critical; its platform approach saves SMBs time and money and QuickBooks’ dominance gives Intuit a clear right to win for other service offerings, including payments and payroll; no single customer represents a meaningful portion of revenue, bestowing pricing power on Intuit; and Intuit’s financial position is strong, with the business generating significant free cash flow.

Paying taxes isn’t optional. Being wrong is costly. Keeping accurate books, paying employees on time, getting paid faster, and accessing capital are crucial for small businesses to survive and thrive. Intuit’s solutions help with all of these, making them mission-critical.

SMBs are weighed down by the large number and disparate nature of their service providers and technology applications, costing them money and trapping their data. Platform companies like Intuit offer key advantages, giving SMBs the opportunity to consolidate vendors, save money, and gain a holistic view of their data, allowing them to use it effectively. Although other platform companies exist, none have what Intuit has: QuickBooks, the dominant accounting suite for SMBs, making Intuit the ultimate SMB platform and giving it a clear right to win across other service offerings, where it is still not significantly penetrated. To demonstrate, in fiscal 2025, Intuit generated more than $3.6 billion of revenue across payroll and HCM and payments, growing 24%, placing it in rare company among publicly traded peers, in terms of both scale and growth:

Intuit generates significant annual increases in average revenue per customer, or ARPC, through the adoption of more, higher-value, features and price increases, likely at-or-above a mid-single-digit rate per year, due to the fragmented nature of its customer base.

Intuit has minimal net debt and generates significant free cash flow, providing a base for shareholder value creation through the development of advanced product features, acquisitions, if necessary, and shareholder returns.

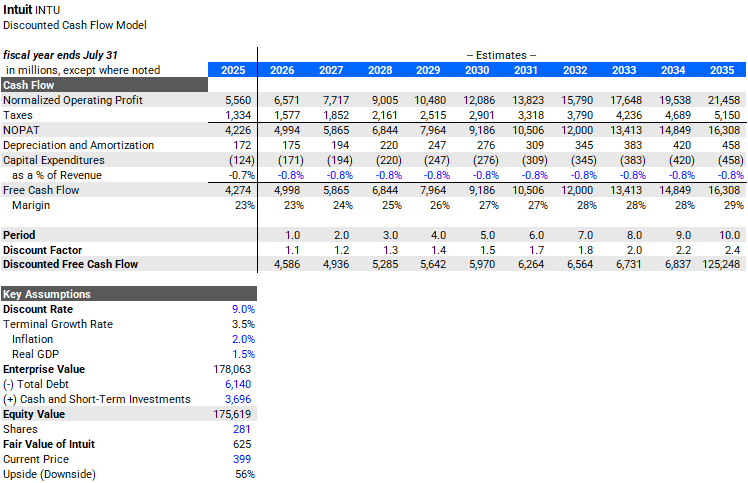

I believe Intuit is worth $625 per share under a realistic scenario, offering meaningful upside to the current price of $400. With more conservative assumptions, including slower growth rates, a higher discount rate, and a lower terminal growth rate, I estimate a fair value of about $475, still providing a margin of safety to today’s price.

Risks

Front and center is the risk that AI will significantly drive down the cost of creating software, flooding the market with viable alternatives to incumbent providers and, at the least, compressing their margins, if not displacing them entirely. Other risks for Intuit include an overhaul of the tax code that radically simplifies it, eliminating the need for human assistance or sophisticated software. Intuit could also stumble if its own AI tools fail to impress or, worse, make mistakes. Intuit’s capital allocation has been suspect. The acquisitions of Credit Karma and Mailchimp were expensive, and the businesses have struggled at times since joining Intuit. Stock-based compensation has increased significantly, requiring substantial share buybacks to offset dilution.

Company Description

Intuit has two blockbuster franchises that dominate their respective categories: TurboTax in consumer tax software, and QuickBooks in SMB accounting software. Both serve as the foundation for broader consumer and SMB ecosystems.

In addition to TurboTax, Intuit’s consumer ecosystem includes Credit Karma, which provides financial product recommendations (credit cards, loans and insurance) and financial services (Credit Karma Money).

Intuit’s SMB platform, anchored by the QuickBooks accounting suite, provides tools that help SMBs operate and grow, including payroll and human capital management, loans, payments, and marketing and customer relationship management (CRM) through Mailchimp.

Below is my estimate of Intuit’s revenue by major product line for fiscal 2025:

Intuit generates most of its revenue from fees for recurring software subscriptions. Other revenue is activity-based, such as the number of employees paid, amount of volume processed, or links clicked, applications completed or accounts opened for financial products. Intuit generated more than 90% of its revenue from the U.S. over the past three fiscal years.

Corporate History

Intuit was founded in 1983 by Scott Cook, a former brand manager at Procter & Gamble, and Tom Proulx, an engineering student at Stanford University. Together, they developed and released Quicken in 1984:

Although the business struggled early, Quicken eventually became the leader in personal finance packaged software, turning back attempts by Microsoft, and it’s Money offering, to challenge its dominance.

In 1992, Intuit released QuickBooks, its accounting software for SMBs. The following year, Intuit went public. Later in 1993, Intuit agreed to acquire Chipsoft, the maker of TurboTax, for approximately $225 million.

Finally acknowledging defeat, Microsoft offered to buy Intuit for $1.5 billion in 1994, the largest software acquisition ever at the time. Following a Department of Justice lawsuit to block the deal on anticompetitive grounds, Microsoft abandoned its plan to buy Intuit in 1995. Over the ensuing years, Intuit introduced additional products and made acquisitions to expand service offerings for SMBs and enter the professional tax channel.

Around the turn of the century, Intuit released online versions of TurboTax and QuickBooks. Although TurboTax online units surpassed desktop units by 2008, QuickBooks Online failed to gain meaningful traction until Intuit released a completely reimagined version in 2013, lighting the spark for accelerating subscriber growth.

During the 2000s and 2010s, Intuit’s portfolio of businesses expanded, then narrowed. In 2007, Intuit bought Digital Insight, a provider of online banking software, for $1.3 billion, only to sell it six years later to Thoma Bravo for $1 billion. Similarly, Intuit purchased Demandforce, a marketing automation platform for SMBs, for more than $400 million in 2012, only to sell it four years later along with Quicken, allowing Intuit to narrow its focus to QuickBooks and TurboTax.

In the late 2010s, Intuit began incorporating AI into its products, launching an expert platform, and delivering done-for-you experiences, including TurboTax Live, introduced in 2018.

The early 2020s brought the transformative acquisitions of Credit Karma ($7 billion in 2020) and Mailchimp ($12 billion in 2021), bolstering Intuit’s consumer and SMB ecosystems and compounding its data advantage.

In 2025, Intuit accelerated its AI strategy, introducing a system of intelligence that relies on agents and AI-enabled humans to automate important workflows for consumers and SMBs, saving them time and money. Intuit also announced a multi-year partnership with OpenAI to make Intuit’s expertise and products discoverable on ChatGPT.

Management

Sasan Goodarzi has been chairman and CEO of Intuit since 2019, following the tenure of Brad Smith (2008 through 2018), who successfully transitioned Intuit to cloud-based software delivery and a recurring subscription revenue model.

Although I believe Sasan has put Intuit on its front foot in terms of capitalizing on the opportunities presented by AI, a very important achievement, the prices paid and strategic rationale for the Credit Karma and Mailchimp acquisitions did not make sense to me. Further, stock-based compensation, as a percentage of Intuit’s revenue, has climbed from 6% in fiscal 2019 to 10.5% during fiscal 2025.

Growth Strategy

Several years ago, Intuit started its journey to become an expert platform for consumers and SMBs, utilizing its data, AI, and humans. Over time, Intuit transitioned from offering primarily DIY software to delivering done-for-you experiences across taxes, accounting, payroll, and payments. This shift drove adoption of more, higher-value features and sustained impressive average revenue per customer (ARPC) growth, and improved retention.

Currently, Intuit is focused on three big bets: deliver done-for-you experiences, make money the center of everything, and disrupt the mid-market. 40% of Intuit’s investment dollars are allocated to its three big bets now, with plans to increase that to 60% over the medium-term:

Deliver done-for-you experiences. Since its launch in 2018, TurboTax Live has reached $2 billion in annual revenue, growing 47% last tax season. Intuit believes the 86 million U.S. filers requiring assistance represent a $35 billion total addressable market, with TurboTax holding less than 6% share. For the upcoming tax season, TurboTax increased its number of offices to 600 from 400 and began marketing earlier to align with assisted filer preparation. Although Intuit does not disclose QuickBooks Live revenue, customers using the service tripled in fiscal 2024 and doubled in fiscal 2025. Intuit is also seeing strong reception for its fleet of AI agents with 2.8 million customers using them in the first four months and 80% returning. Done-for-you experiences generate more revenue for Intuit. TurboTax Live averages about $225 per return versus $85-90 without assistance. In addition to generating revenue, QuickBooks Live customers attach other services at a rate 22 points higher than regular QuickBooks subscribers.

Make money the center of everything. Intuit delivers larger and faster refunds (early access to $14 billion of refunds during fiscal 2025), enables businesses to get paid earlier (5 days, on average, by using Intuit’s payments agent), provides SMBs with access to capital ($4 billion facilitated in fiscal 2025), and maximizes savings for consumers by matching them with the right financial products. In fiscal 2025, Intuit’s payments business and Credit Karma generated $3.9 billion in revenue, growing one-third.

Disrupt the mid-market. Intuit released its Intuit Enterprise Suite (IES), an all-in-one AI-powered platform (accounting, marketing, payroll, and payments) for more complex businesses with up to $100 million in revenue, in September 2024, building on its QuickBooks Advanced offering for smaller mid-market customers. Most customers that leave Intuit’s SMB ecosystem each year either go out of business or graduate to a more sophisticated solution. With IES, Intuit can grow alongside its customers. QuickBooks customers that switch to IES generate more than 2 times the revenue over the life of the contract. Of the 1.8 million businesses in its target market, 800,000 already use a QuickBooks solution other than Advanced or IES, providing significant runway for growth. During fiscal 2025, mid-market revenue was $1.17 billion, growing about 40%.

Industry and Competitive Landscape

Although Intuit leads the DIY consumer tax and SMB accounting software categories, it faces formidable competitors in each, and more significant competition across its other businesses, including payroll and HCM and payments.

QuickBooks. Among the smallest businesses, QuickBooks competes against Microsoft Excel and Google Sheets, as well as comparable cloud-based offerings from Sage and Xero. For more complex mid-market businesses, QuickBooks Advanced and Intuit Enterprise Suite compete against enterprise resource planning software, including Microsoft Dynamics, Oracle NetSuite, and Sage Intacct. Workday, which has historically focused on enterprises, recently launched Workday GO, an AI-powered HR and finance platform for mid-sized businesses.

Payroll and HCM. Intuit competes against several large payroll and HCM providers, including ADP, Paychex, and Gusto in the small business market and Paycom Software and Paylocity among mid-market companies. Historically, Intuit provided payroll processing, tax filing, and time and attendance solutions but lacked the robust HCM suite offered by most competitors. With the 2025 acquisition of GoCo, Intuit broadened its HCM offering, adding hiring, workforce management, and benefits administration.

Payments. Intuit faces significant competition across its payments offerings. For merchant acquiring, Intuit competes against banks (JPMorgan, Bank of America, Wells Fargo, and U.S. Bank) as well as Fiserv, Global Payments, Square, Adyen, and Stripe, among others. For its bill pay offering, Intuit competes against BILL Holdings, its former partner, and Melio, who is now owned by Xero.

Platforms. Similar to Intuit, companies like Square and Toast offer SMBs an all-in-one platform, including business management and point-of-sale software, marketing, CRM, payments, payroll and HCM, and access to capital. Unlike Intuit, Square and Toast do not offer accounting software. Instead, they provide an integration with QuickBooks.

TurboTax. Intuit faces a small number of large competitors in DIY consumer tax software, including H&R Block and TaxAct, along with several smaller providers offering less robust software for simpler tax situations. In the assisted category, TurboTax Live also competes against H&R Block, which has a significantly larger store footprint and software with human-interaction capabilities. However, most assisted returns are handled by CPAs, some using Intuit’s professional tax offerings.

Pricing. Many of Intuit’s markets, although competitive, present opportunities to consistently raise prices on a fragmented base of SMBs and consumers, especially to capture added value from new features. Although Intuit never specifies an impact from like-for-like price increases, only referencing ‘higher effective prices’, competitors that are less advantaged have been more specific about pricing impact. On its fiscal 2025 conference call in November 2025, Sage stated that over the past four years, pricing expanded between 4-5%, with a step-up to a 5.5% increase during fiscal 2025, reflecting value created by the introduction of Sage’s AI tools. In payroll and HCM, Paychex, which focuses heavily on the small business market, has historically raised prices 3-4% annually. H&R Block takes low-single-digit price increases annually across its DIY and assisted base. Payments is an area where prices are more likely to be stable than rising for SMB customers, reflecting a heightened, but still rational, competitive environment.

Retention. Companies serving SMBs typically retain 80% to a low-90% of customers and revenue annually, with the largest source of attrition being companies going out of business. For fiscal 2025, QuickBooks retention was 83% and TurboTax retention was 77%. Below is a sample of retention rates, where available, among SMB service providers:

Financial Review and Outlook

Intuit separates itself into four business lines: (1) Global Business Solutions, which includes QuickBooks, Money (its name for its merchant acquiring, bill pay, and capital businesses), Payroll and HCM, and Mailchimp; (2) TurboTax; (3) Credit Karma; and (4) ProTax.

Reporting Note: Although Intuit reported all four business lines as segments historically, disclosing revenue and a contribution margin for each, starting in fiscal 2026, Intuit reports just two segments: Global Business Solutions and Consumer, which incorporates TurboTax, Credit Karma and ProTax. While Intuit still discloses revenue for TurboTax, Credit Karma and ProTax, it no longer discloses a contribution margin for each, instead reporting only a single contribution margin for the new Consumer segment.

Global Business Solutions

The Global Business Solutions segment consists of an Online and Desktop Ecosystem. The Online Ecosystem includes online versions of QuickBooks, related services, and Mailchimp. The Desktop Ecosystem includes desktop versions of QuickBooks, related services, and financial supplies.

Given Intuit’s focus, Online Ecosystem growth has been significantly stronger. Since fiscal 2020, Online Ecosystem revenue has grown at a compound annual rate of 31% versus 8% for the Desktop Ecosystem:

Excluding the Mailchimp acquisition, Online Ecosystem revenue has grown at a compound annual rate of 27% since fiscal 2020:

Excluding Mailchimp, online paying customers have grown at a compound annual rate of 9% since fiscal 2020 with 10% growth in QuickBooks paying customers:

For QuickBooks paying customers, the U.S. represents about three-fourths of the total (74%). Since fiscal 2020, U.S. paying customers have grown at a compound annual rate of 12% with 6% growth internationally:

Excluding Mailchimp, Online Ecosystem average revenue per customer, or ARPC, has grown at a compound annual rate of 16% since fiscal 2020:

Factors contributing to the increase in ARPC include like-for-like price increases, likely at-or-above mid-single-digits annually, the adoption of higher value versions (QuickBooks Advanced and Intuit Enterprise Suite) and features (QuickBooks Live), and the introduction and adoption of more services—payments, payroll and HCM, bill payment and capital.

As an example, since fiscal 2020, paying customers across the mid-market (QuickBooks Advanced and Intuit Enterprise Suite) have grown at a compound annual rate of 36% with 57% growth in revenue as ARPC of $3,713 for the mid-market is four times higher than ARPC across the Online Ecosystem:

On a pro-forma basis, Mailchimp revenue has grown at a compound annual rate of 9% since it was acquired during fiscal 2022, but growth has slowed from 15% in fiscal 2023 to 11% in fiscal 2024 to less than 2% in fiscal 2025. Although Intuit believes Mailchimp will exit fiscal 2026 at a double-digit growth rate, revenue declined during the first quarter on a year-over-year basis:

Despite paying customers declining by a compound annual rate of 2%, Desktop Ecosystem revenue grew at a compound annual rate of 8% since fiscal 2020 due to the transition to a subscription revenue model with pricing comparable to online paying customers, which significantly increased revenue during fiscal 2023 and 2024. Desktop Ecosystem revenue growth should be more modest moving ahead:

TurboTax

Since fiscal 2020, TurboTax grew revenue at a compound annual rate of 9% with 34% growth in TurboTax Live and 2% growth in DIY. TurboTax Live now represents 41% of total TurboTax revenue, up from just 15% in fiscal 2020:

TurboTax Live returns have grown at a compound annual rate of 23% since fiscal 2020, reaching approximately 9 million in fiscal 2025 with an average revenue per unit, or ARPU, of $222. All other DIY returns, including free and paid, were about 32 million in fiscal 2025, generating an ARPU of about $90.

Intuit’s goal is to maintain TurboTax dollar share of the DIY category, which is currently at-or-above 80%, while disrupting the assisted category, which represents a $35 billion TAM, according to Intuit, implying TurboTax is just 6% penetrated, indicating significant runway for growth.

Credit Karma

Credit Karma has proven more cyclical than expected since Intuit bought it. After growing revenue 58% on a pro-forma basis in fiscal 2022, Credit Karma’s revenue declined 9% in fiscal 2024 as rising interest rates dampened demand for home and auto loans. In fiscal 2025, growth rebounded strongly with revenue up 32%. Intuit is taking steps to reduce Credit Karma’s cyclicality by targeting more prime customers and expanding into insurance, which is non-discretionary. Ultimately, Intuit aims to build an ecosystem that engages consumers year-round, not just during tax season. This includes converting Credit Karma customers to TurboTax users. Last tax season, Credit Karma added 1 point to TurboTax’s revenue growth. Another opportunity is to move refunds from TurboTax to Credit Karma Money accounts, where Intuit can earn additional revenue as funds are spent down and potentially convert some customers to a primary financial relationship with Credit Karma.

ProTax

At just 3% of revenue, ProTax is a small part of Intuit but a reliable mid-single-digit grower. Since fiscal 2020, ProTax revenue has grown at a compound annual rate of 5%, ranging from 3% to 7% annually.

Income Statement

Over the past five fiscal years, Intuit’s organic revenue growth averaged 14%, up slightly from the previous five-year period when it averaged 13%, never falling below double digits. On a non-GAAP basis, which excludes the amortization of acquired intangible assets and stock-based compensation, gross margin has ranged from 82% to 84%, finishing fiscal 2025 at less than 83%. Non-GAAP operating margin expanded to 40% in fiscal 2025 from 34% in fiscal 2020; however, this was due to a significant step-up in stock-based compensation. On a normalized basis burdened for stock-based compensation, Intuit’s operating margin was roughly flat from fiscal 2020 to fiscal 2025.

Balance Sheet and Cash Flow

As of October 31, 2025, Intuit had $6.14 billion of debt versus $3.70 billion of cash and short-term investments, resulting in net debt of $2.44 billion, representing just 0.4 times trailing twelve-month (TTM) EBITDA, providing ample room for Intuit to make acquisitions or more aggressively repurchase shares given the discounted valuation. Intuit generated about $6.35 billion of free cash flow over the TTM, representing 5.7% of current market cap. After excluding stock-based compensation, free cash flow yield falls to about 3.9%. Intuit typically uses free cash flow to buy back shares to offset dilution. Over the past five fiscal years, Intuit has spent $9.6 billion to buy back its own stock, barely making a dent in the share count after accounting for dilution from the Credit Karma and Mailchimp acquisitions, highlighting the real-world cost of Intuit’s excessive stock-based compensation program.

Outlook and Valuation

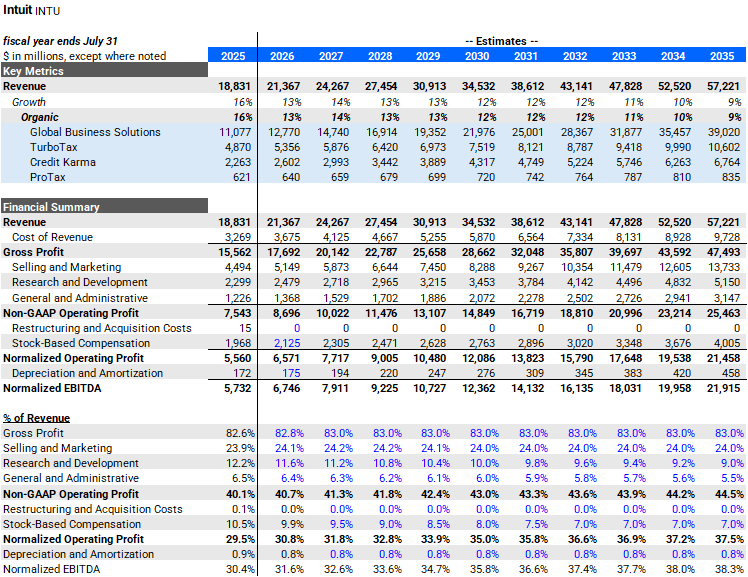

From fiscal 2025 to fiscal 2030, I assume Intuit’s revenue grows at a compound annual rate of less than 13% based on 15% growth in Global Business Solutions, 9% growth for TurboTax, 14% growth for Credit Karma, and 3% ProTax growth. Some of my key revenue assumptions include: (1) paying customers for the Online Ecosystem, excluding Mailchimp, grow at a compound annual rate of 6% (versus 9% over past five years); (2) Online Ecosystem, excluding Mailchimp, ARPC grows at a compound annual rate of 12% (versus 16% over the past five years), benefitting from the same tailwinds—increased adoption of higher value versions, services adoption, and like-for-like price increases in the low-to-mid single digits; (3) Mailchimp revenue grows at a compound annual rate of 8%; (4) Desktop Ecosystem revenue grows at a compound annual rate of 4%; and (5) TurboTax Live and DIY revenue grows at compound annual rates of 16% and 3%, respectively. I expect Intuit’s normalized operating margin, which is burdened by stock-based compensation, to rise from 29.5% to 35%, reflecting leverage from cash-based operating expenses and a decline in stock-based compensation as a percentage of revenue to 8%, from 10.5% during fiscal 2025.

In the out years (fiscal 2030 to fiscal 2035), I assume revenue growth of 10.5% with 12% growth in Global Business Solutions, 7% growth in TurboTax, 9% growth in Credit Karma, and 3% ProTax growth. My normalized operating margin moves from 35% to 37.5% by fiscal 2035.

My fair value for Intuit is $625. Key assumptions for my DCF model include a tax rate of 24%, depreciation and amortization and capital expenditures that average less than 1% of revenue over the course of my forecast, a discount rate of 9%, which reflects Intuit’s strong financial position, mission-critical solutions, and fragmented customer base, which eliminates concentration risk and bestows pricing power, and a terminal growth rate of 3.5%, reflecting low single digit growth in both nominal GDP and inflation. Terminal value represents about 70% of total discounted cash flows.

Under a scenario where my revenue growth assumption is 1.0-1.5% slower annually, the normalized operating margin reaches only 36% by fiscal 2035 (not 37.5%), and I raise my discount rate to 10% to reflect the heightened risk from AI, my fair value for Intuit falls to about $475.

As always, thank you for reading, and if you’ve enjoyed this, please consider sharing, liking, commenting or subscribing!

Disclosure: Of the companies mentioned in this report, as of February 16, 2026, I am long Intuit, Adyen, Block, Global Payments, and Paychex. Others not mentioned, but which I am long include Visa and Shift4 Payments. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.

Love this companies current numbers