It’s déjà vu all over again

PayPal found itself in a familiar situation yesterday. The company beat revenue and earnings estimates, raised guidance, yet its share price still dropped. So, what’s the deal?

Despite exceeding guidance, key metrics are not improving

On a reported basis, transaction margin dollars grew 6.5% during Q2, above guidance of 4%-5%, but still down about 1% from Q1.

However, excluding a non-recurring benefit, growth was approximately 5%, the slowest since Q1 2024.

“TM dollars also benefited from a roughly 1.5 point one-time contribution from the renewal and expansion of our relationship with a key payment partner.”

Jamie Miller, CFO of PayPal on the company’s Q2 earnings call

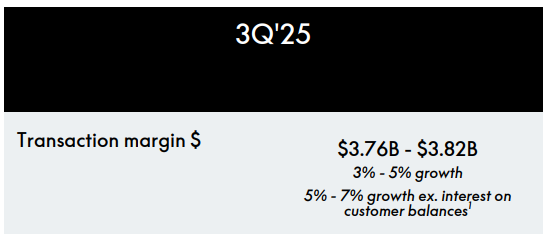

Plus, the company guided to 3%-5% growth in Q3, suggesting further slowing.

Source: PayPal’s Q2 earnings presentation

While bulls may highlight a stronger rise in transaction margin dollars excluding interest on customer balances, investors should note their significant contribution. Over the past four quarters, PayPal’s results showed nearly $1.3 billion in interest on customer balances, accounting for 21% of the company’s non-GAAP operating profit, highlighting potential downward pressure on profitability in a falling rate environment.

Branded checkout TPV rose 5% in Q2, slightly up from Q1, but still near the lower end of the range since early 2023.

And PayPal noted:

“As we moved through the quarter, we observed a slight softening in retail spending in the U.S., most apparent in areas likely impacted by tariffs such as Asia-based marketplaces with higher exposure to goods sourced from China.”

Jamie Miller, CFO of PayPal on the company’s Q2 earnings call

PayPal’s competitive strength is in doubt

My primary concern with PayPal is its ability to deliver value to merchants. In the beginning, PayPal was nearly alone in its ability to facilitate online payments for small and mid-sized businesses. As competitors emerged, PayPal’s value proposition shifted to leveraging the spending power of its hundreds of millions of consumers for the benefit of merchants accepting PayPal.

Now, PayPal faces pressure from all sides:

Shopify offers an all-in-one commerce platform for small and mid-sized businesses, with integrated payments and capital. Additionally, the company has built its own two-sided network, Shop Pay, which had more than 150 million users at the end of 2024.

Adyen and Stripe offer comprehensive payments engines for enterprise customers and small to mid-sized businesses through its platform offerings, transitioning from digital-only initially to an omni-channel provider today.

Apple Pay has eclipsed PayPal in both users and merchants, offering consumers an experience that is very similar to PayPal’s, in my opinion.

Is increased product velocity helping or hurting?

After listening to the conference call yesterday, I concluded PayPal has a lot going on: Fastlane, rewards, personalized offers, advertising, BNPL, in-store, new credit and debit cards, Pay with Venmo, agentic commerce, stablecoins, pay with crypto, and PayPal World. Ambition is fine, but PayPal has previously admitted to overextending itself, and I worry it may be doing so again.

Now, for the good news

I’m not counting out PayPal, and neither should you. I think the company has valuable assets:

A globally recognized payments brand that engenders trust among consumers and merchants.

Hundreds of millions of consumers that habitually transact with the company’s products.

Existing relationships with millions of merchants, including many of the largest online retailers in the world.

Extensive transactional data that supports the company’s efforts in lending, advertising, and agentic commerce.

But the company’s most important asset is its balance sheet. Unlike other legacy payments companies that have high debt loads, PayPal has minimal net debt. This provides flexibility for the company to pursue transformative strategic acquisitions or supersize its buyback efforts, which are currently funded by PayPal’s significant free cash flow. By my estimate, taking the company’s net debt-to-EBITDA ratio to 2.5x would free up $16.3 billion, allowing PayPal to repurchase more than 23% of its shares outstanding at current prices.

The bar is (extremely) low. Following yesterday’s decline, shares trade at 13.7x the midpoint of the company’s 2025 EPS guidance of $5.15-$5.30. PayPal’s market cap of approximately $70 billion represents less than 11x the midpoint of the company’s 2025 free cash flow guidance of $6-$7 billion. Like other legacy payments companies, the market seems extremely skeptical of PayPal’s ability to sustain long-term growth. While I have concerns, and prefer a company like Fiserv over PayPal, the risk-reward looks extremely favorable for both companies at these levels.

Disclosure: Of the stocks mentioned in this report, I am long Fiserv. I do not hold a position in PayPal. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.