Block: One step forward, one step sideways

Volume momentum builds for Square, but lending expansion masks further slowing in valuable gross profit streams at Cash App

The Big Picture

Despite disappointing Q1 results, which featured a reduction in full year guidance, shares of Block rallied nearly 75% from its post-earnings lows ($46.53 on May 2 to $80.74 on July 25), benefitting from:

a positive intra-quarter update on Cash App (inflows up 13% in April)

an expectation that Block was taking a conservative approach with guidance, setting the stage for beat-and-raise quarters ahead

well received product introductions at Square and Cash App

a general improvement in risk sentiment, including Bitcoin prices, and

the announcement that Block would be joining the S&P 500 (announced after the market close on Friday July 18)

Fast forward to last Thursday (August 7) and Block delivered what look liked strong results:

Gross profit growth accelerated to 14%, up from 9% in Q1, and well ahead of guidance for 9.5% growth

Adjusted operating margin of nearly 22% expanded 380 bps over the prior year period and easily exceeded guidance of 18%

On the back of those results, Block raised its annual guidance and now expects gross profit growth of 14.4% in 2025 (up from 12%), and an adjusted operating margin of 20% (up from 19%). Shares initially rallied in after-hours and early trading Friday (August 8), but lost momentum throughout the day, eventually closing down 4.5% to $73.39.

Puts and Takes

My initial reaction to Block’s results were this:

The acceleration in Square’s U.S. GPV growth to 7% was a positive development, suggesting Square is back in share gain mode.

The significant expansion in Cash App Borrow originations is masking weaker underlying performance at Cash App.

Under closer scrutiny, my initial assessments hold up, mostly. Let’s take a look.

Square: Back in share gain mode

In my mind, Square is pretty straightforward. For the last three quarters, Square’s U.S. GPV grew below the U.S. card market, falling to an anemic 5.6% rate during Q1. But in Q2, it accelerated 140 bps to 7%, outpacing the market’s growth of 6.5%. Additionally, international GPV growth jumped back to 24% during Q2, bringing Square’s global constant currency GPV growth to about 10%.

The improvement was broad-based, but most significant in food and beverage and retail, which reported 10% growth, its highest level since Q1 2023.

Further on the plus side, Block said:

“…we expect to deliver low double-digit GPV growth in the third and fourth quarters, accelerating modestly from the 10% growth we delivered in the second quarter.”

But that was tempered by:

“We expect third quarter gross profit in the high single-digit range and fourth quarter growth to track roughly in line with GPV growth.

Square's third quarter gross profit growth is impacted by a few dynamics, including our decision to increase operational flexibility at a processing partner, which modestly increases processing costs and further investments in hardware as a successful go-to-market driver for Square.”

Amrita Ahuja, CFO and COO of Block

The chart below highlights the convergence between Square’s gross profit and GPV growth. It’s important to note that excluding a $20.4 million benefit in Q2 from a processing vendor settlement, Square’s gross profit growth would have been 9.1%, below GPV growth of 10.1%. In addition to an increase in hardware losses and the temporary increase in processing costs, it may be possible Square’s success upmarket is bringing somewhat lower net take rates, less SaaS fees relative to GPV, or lower Square Capital originations, and the company’s reliance on partnerships to drive sales is resulting in referral fees that reduce Square’s gross profit relative to GPV.

Cash App: Borrow expansion masks underlying slowing

My thesis on Cash App is that lending-fueled gross profit growth is less valuable than spending-fueled.

In Q2, I estimate gross profit from BNPL and Cash App Borrow jumped 48%, up from a 31% increase in Q1, while Spend and Transact1 gross profit grew only 7%, down from about 10% growth during Q1:

The slowdown in Spend and Transact gross profit mirrors the decline in the growth of Cash App Card monthly active users (MAUs):

While I estimate gross profit from BNPL and Borrow represented one-third of Cash App gross profit in Q2 2025, I believe it could reach 45% of Cash App gross profit by the end of 2026.

Taking account Block’s guidance for Square in the second half of 2025 and my belief Cash App’s Spend and Transact gross profit growth will remain moderate, implies a further ramp in lending activity to achieve Block’s consolidated goals for 2025. I estimate Cash App Borrow originations will rise from $4.5 billion in Q2 to more than $7 billion by Q4 2025, before leveling off during 2026 with an exit rate of 15% growth in Q4 2026.

Although I believe additional increases in Cash App Borrow originations will result primarily from an expansion in the number of monthly actives, it appears the increase during Q2 was driven more by an increase in originations per monthly active, which could mean monthly actives were borrowing more or increasing the size of their borrowing.

Modeling it out

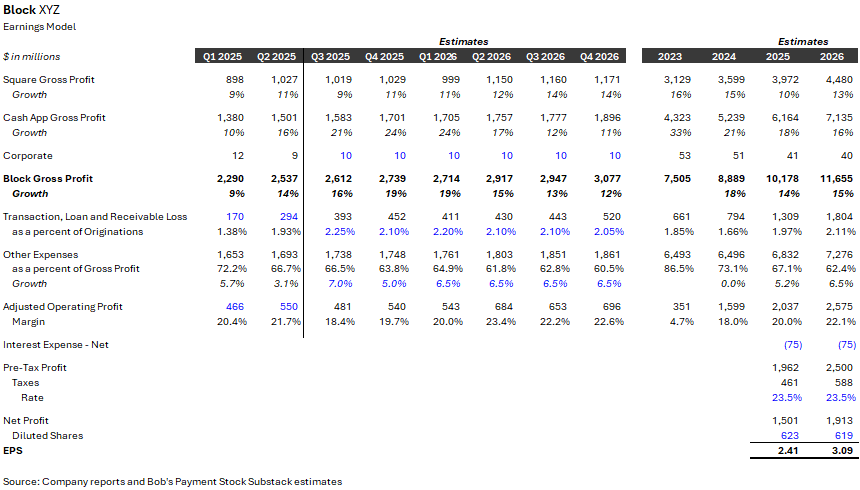

I’m attaching a full (but streamlined) version of my Block model at the end of the post, but here are highlights for 2026:

Square GPV growth of 12% versus 10% for 2025

A net take rate of 1.09%, level with 2025

A loss of $166 million on hardware sales, up from $137 million during 2025

Square Capital originations up 15%

Other Square subscription revenue (primarily SaaS fees) up 15%

Spend and Transact Cash App gross profit up 7%, similar to 2025

BNPL GMV of $48.7 billion, up 23%

Cash App Borrow originations of $29.3 billion, up 45%

Loss rates on Square Capital (3-4%), BNPL (at, or less than, 1%) and Borrow (at, or less than, 3%) being around historical levels with the consolidated increase in losses tied to a greater mix of Borrow originations

After flat other expense2 growth during 2024 and 5% growth in 2025, I assume growth of 6.5% during 2026

The output, for 2026, is:

consolidated gross profit growth of 15%

an adjusted operating margin of 22%, and

EPS of $3.09, which assumes:

$75 million of net interest expense

a 23.5% effective tax rate, and

619 million shares, which implies essentially no additional share repurchases from this point

Thoughts on the stock

I still hold that Block is unlikely to move much higher until they demonstrate a pickup in Cash App Card MAU growth, catalyzing an acceleration in higher value spending-based gross profit streams. Now, although nascent, they’ve delivered on their promise to return Square GPV to market share gains, but the question may linger at what cost to gross profit?

The good news for Block bulls is that valuation starts to look decent based on 2026 numbers, even when fully burdened for stock-based compensation. Based on my $3.09 estimate, shares trade at less than 24x, a reasonable entry point if you believe Block can sustain balanced gross profit growth in the low double-digits. I continue to believe there are risks to rapidly expanding Block’s lending and key questions remain about how these loans will perform, or if they will even be originated, during recessionary periods.

From my perspective, there are more compelling opportunities to invest in across Payments and FinTech than Block, so that’s what I’ll continue to do.

Disclosure: I do not hold a position in Block. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.

Spend and Transact represents gross profit from interchange, ATM fees, Cash App Pay, and instant transfer fees

Non-GAAP expenses excluding transaction, loan and receivable losses

I'm trying to get to your Spend and Transact GP. $421mn Cash card GP + $20mn cash app pay gross profit + 320mn instant deposit GP + $42mn cash app transaction GP. That gets to $804mn total. 1.9% y/y growth for 2Q. I get to 0.4% for 1Q. What am I missing here? Thanks a lot for the help