My Investing Checklist

A checklist identifies stocks for additional research and eliminates low-quality options

Managing an individual stock portfolio can be daunting. Even experienced managers beat the market less than half the time, if they’re lucky.

For investors unwilling to try, an index fund or ETF is suitable, guaranteeing broad equity exposure.

For those that would like to try, I recommend creating a checklist, or set of guidelines, to narrow the field of potential investment candidates. While this process can identify companies for further study, an important function is to eliminate low-quality options.

Each investor is unique, so your list may look different than others. And more importantly, this is a starting point. More work is required. Additional research may yield an above-average company, or one you consider great.

Before jumping in, here are some rules I follow when constructing my portfolio:

I’m interested in American-based companies that report in U.S. dollars and abide by generally accepted accounting principles, or GAAP

10-25 stocks seem like the right amount to me. Anything less may offer insufficient diversification. Anything more may be too time-consuming

I’m comfortable owning more stocks in my area of expertise. However, I would never invest only in one place, and neither should you

For other stocks, I prefer broad diversification, with at least some exposure in the major areas of technology, healthcare, financials, consumer, and industrials

I’ll only consider a company if I’m able to understand what they do and how they make money and

There are no size (i.e., large, mid, or small cap) or style (i.e., growth or value) constraints

Data Sources. I gather information from SEC filings (which can be found at sec.gov) and the company’s investor relations website. I recently discovered the Quartr app for my iPhone, which is a great - and free - resource for analyzing earnings conference calls and other presentations made by companies.

And now to the checklist.

Disclosure. Companies must provide enough disclosure for investors to assess performance and estimate fair value. If they do not, I’m unlikely to move forward. Good disclosure includes:

Revenue broken down by key product or service, segment, and geography

Key business drivers and

Detailed expenses, including amortization of acquired intangible assets, restructuring, and acquisition-related expenses

Across the market, the trend is for greater disclosure. Any company reducing disclosure should be given additional scrutiny.

Growth. I prefer companies that grow consistently and:

Balance it across increases in volume and price and

Source it from a large number of small and medium-sized customers as opposed to a small number of large customers

I avoid growth that is:

Inconsistent

Frequently negative or

Dependent primarily upon price increases or acquisitions

Profitability. Companies I invest in should be making money, and margins should be steady or moving higher. I look for:

Profit expansion supported by revenue growth

I dislike profit expansion that relies on:

Perpetual efficiency programs and restructurings or

Cost savings from acquisitions that have significant upfront and ongoing costs

Defining normalized operating profit can be tricky, and companies put their best foot forward, excluding expenses they claim are non-recurring or non-cash but occur frequently and have real costs. Here is how I defined normalized operating profit:

GAAP operating profit + amortization of acquired intangible assets

I do not add back:

Stock-based compensation

Restructuring or

Acquisition-related expenses

Free Cash Flow. Among the most important measure for a company is free cash flow, which represents cash left over after capital spending and investments in working capital. I am most interested in free cash conversion, which is defined as free cash flow divided by net profit.

If a company’s free cash conversion rate is at or above 100%, earnings quality is high but

If free cash conversion is materially below 100%, earnings quality is low, and investors should consider assessing valuation as a multiple of the lower free cash flow as opposed to earnings

Financial Health. I prefer companies with minimal debt at fixed rates. Moderate levels of debt are acceptable if the business is predictable. I dislike companies with:

High debt at variable rates

Moderate debt and an unpredictable business and

Cash that meaningfully exceeds the day-to-day requirements for running the business

What constitutes minimal, moderate and high levels of debt? I use gross debt-to-EBITDA1 and consider 0-1x as minimal, 1-4x as moderate, and over 4x as high.

Returns. A company that generates large amounts of cash from a moderate asset base is ideal. My favorite measure of asset efficiency is return on average tangible assets and is calculated as:

NOPAT ÷ average tangible assets

NOPAT stands for net operating profit after taxes and should be calculated as normalized operating profit less an allowance for taxes and

Tangible assets equal total assets minus goodwill, other intangible assets, excess cash, and assets not belonging to the company

Put another way, tangible assets are:

Cash to cover the day-to-day requirements of running the business

Accounts receivable

Inventory

Prepaid and other current assets

Net investment in property and equipment and capitalized software and

Operating leases

Capital Allocation. Deciding how to allocate capital is management’s most important job. The options for excess capital are:

Accumulating cash

Paying a dividend or repurchasing shares

Reducing debt or

Buying another company

I dislike companies that:

Pay an unsustainable dividend

Repurchase shares at unreasonably high levels

Consistently use debt to repurchase shares or

Acquire companies that do not compliment the current business and result in near-term earnings dilution

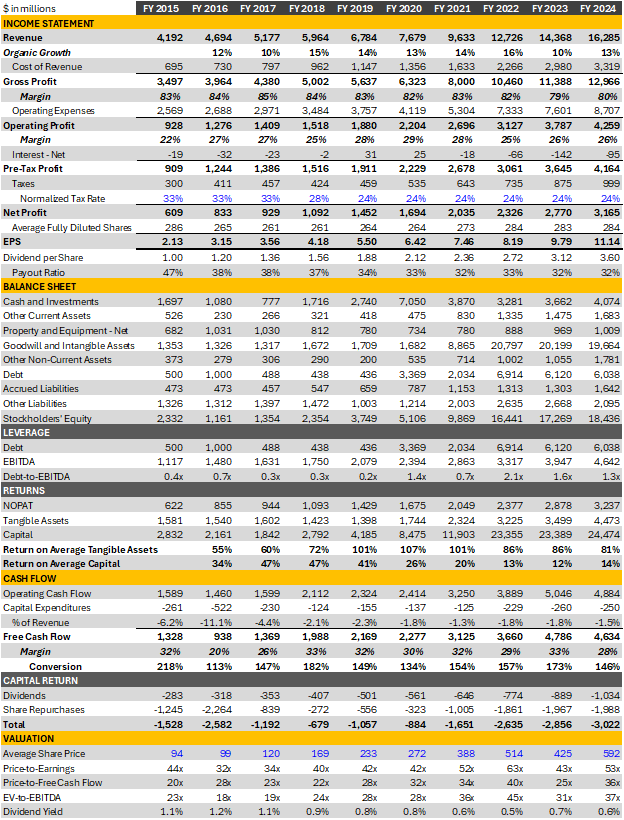

Putting the Checklist into Action. No company is perfect. Even if one meets most of my requirements, the company is likely to have strikes against it. To demonstrate, I will evaluate Intuit using my checklist (disclosure: I am long Intuit):

Disclosure. Intuit discloses product, service, and segment revenue and revenue from key products, including QuickBooks, TurboTax, and Credit Karma. However, it no longer discloses the number of QuickBooks subscribers or TurboTax units.

Growth. Intuit’s organic revenue growth has averaged 13% since fiscal 2015 and has not been below 10% during any year. The company serves millions of small businesses and consumers, and growth is balanced across units and adoption of higher value products, such as TurboTax Live and QuickBooks Advanced and Enterprise.

Profitability. Intuit’s normalized operating margin has averaged 26% over the last ten years and was 26% during its last fiscal year. Restructurings have been rare. Yet, Intuit provides an adjusted operating profit figure that adds back stock-based compensation and restructuring expenses, which may be misleading.

Free Cash Flow. Intuit’s free cash flow has equaled 154% of the company’s net profit over the last ten years. While great, this reflects Intuit’s significant use of stock-based compensation, which results in dilution for shareholders.

Financial Health. Intuit finished last fiscal year with a debt-to-EBITDA ratio of 1.3x. Further, about 90% of the company’s debt is fixed rate notes.

Returns. Intuit’s return on average tangible assets is high, even for software companies, averaging 84% over the last ten years.

Capital Allocation. Intuit pays a growing dividend and consistently repurchases shares. However, most repurchases go toward offsetting dilution from stock-based compensation. To demonstrate, during the last five years, Intuit’s share count increased about 2 million after adjusting for shares issued in conjunction with acquisitions despite repurchasing 5.5 million shares for more than $7 billion. Finally, I do not believe Intuit’s acquisition of Credit Karma was the best use of capital as it did not compliment the company’s leading small business and consumer tax products.

Figure 1. Intuit’s summary financials

Source: Intuit reports and SEC filings

EBITDA is defined as earnings before interest, taxes, depreciation, and amortization. Similar to normalized operating profit, I define EBITDA as GAAP operating profit + depreciation and amortization. I do not add back stock-based compensation, restructuring, or acquisition-related expenses.