PayPal: Past, Present and Future

A deep numbers dive

Investment Brief

PayPal is at a pivotal moment. Although underlying transaction margin dollar1 (TM$) growth is poised to accelerate to 7% this year, a closer look reveals a mixed picture, with some 2025 tailwinds unlikely to recur (a BNPL fee increase and significant OVAS credit revenue growth). Recent commentary suggests the macro environment is weighing on PayPal’s core customers, putting downward pressure on volume growth during the key holiday shopping season. Although PayPal frames planned 2026 investments as exploiting long-term opportunities, I’m skeptical the company is operating from a position of strength and instead view them as playing defense against highly capable competitors in each of its markets. Right now, the company’s long-term strategy appears to cast a wide net, but none of the initiatives seem like obvious winners with agentic commerce and stablecoins true wildcards, in my opinion. The decision to apply for a U.S. banking charter may be too little, too late, and cuts against the company’s prior goal of maintaining an asset light balance sheet.

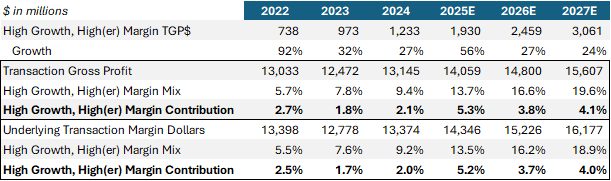

That being said, my analysis suggests PayPal’s high growth, high(er) margin products—BNPL, Pay with Venmo, and debit cards—have reached the critical mass necessary to contribute 4% to PayPal’s underlying TM$ growth, a solid base that puts it within striking distance of its 7-9% growth goal by 2027:

The last couple points may prove to be the most challenging as the same analysis implies PayPal Pay Now Online Checkout TPV—which makes up around half of the company’s transaction gross profit dollars2 (TGP$)—will grow nearly 200 bps slower during 2025, at just 2.6%. At that level, the mid to high-end of the 7-9% range looks firmly out of reach, and achieving the low-end that much more difficult:

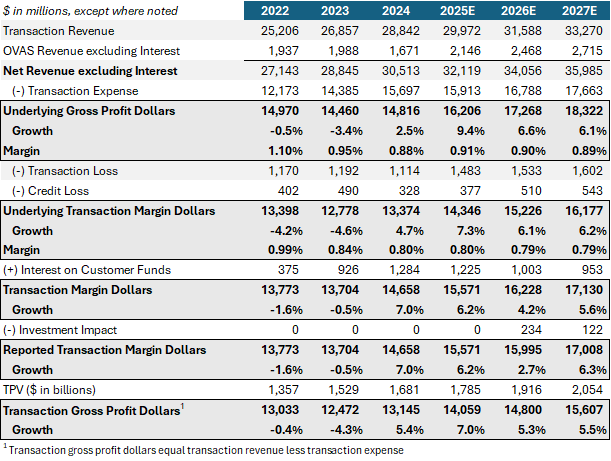

Still, under reasonable scenarios, I believe pre-investment underlying TM$ growth could be at-or-above 6% in both 2026 and 2027, but that relies partially on continued attractive growth in OVAS credit revenue and normalizing transaction loss rates. Unfortunately, with falling short-term interest rates and its planned investments, reported TM$ growth is likely to be less than 3% in 2026 with a step-up to about 6% growth in 2027 if PayPal halves its 2026 investment levels and the Fed cuts only two more times:

Of course, the market would prefer PayPal meet the commitments it laid out at its Investor Day earlier this year. But is it really required to make the stock work from this point, given where it trades (8.6x the midpoint of its 2025 FCF guidance)? I say no, but the market seems to view a mid-single-digit organic grower in payments as damaged goods, with growth more likely to move sustainably lower than higher.

While I had initially planned to focus my article solely on the company’s recent performance, I’ve expanded the scope to include PayPal’s past performance and my view of their mistakes, the company’s current composition, recent financial performance, the 2026 and 2027 outlook, and select future opportunities.

PayPal’s Past to Present

To make a long story short, PayPal’s business has changed dramatically over the past decade, and not in a good way. The volume mix is more P2P, and less merchant; more domestic, and less cross-border; more enterprise, and less small business; and more carded, and less balances and ACH:

The result: a dramatic decline in the company’s transaction margin3. In 2015, PayPal earned 2.07% on every dollar of volume processed across its platform—now, in 2025, they are expected to clear just 0.87%:

How did this happen? There are several reasons why, but I’ll focus on a couple key events and strategic missteps that caused PayPal to lose out on highly valuable volume that, in many cases, was theirs to win or lose:

Stop Steering. In 2016, under pressure from Visa and Mastercard, PayPal agreed to stop “steering” customers to lower cost funding options, including a checking account or existing balance. As a result, more customers chose to complete purchases with a debit or credit card, raising the cost for PayPal and lowering their transaction margin.

eBay Transition. In 2018, at the conclusion of a commercial relationship formed when eBay and PayPal separated, eBay announced it was partnering with Adyen to power a portion of the payments on its platform, resulting in lost volume for PayPal and a lower take rate on remaining eBay volume, commensurate with an enterprise merchant. To demonstrate, in 2015, PayPal generated net revenue of roughly $2.4 billion on $60 billion of eBay volume, implying a take rate of about 4%. By 2025, I estimate PayPal will generate only $462 million of net revenue on approximately $28 billion of eBay volume, implying a take rate of 1.6-1.7%.

The Rise of Venmo. As a P2P app, Venmo has been a runaway success. As a money-making concern, Venmo’s track record, although improving, has been less than stellar. Consider this: the $1.7 billion net revenue PayPal expects Venmo to generate during 2025 implies an ARPU of $26; excluding BNPL and interest income, Block’s Cash App will generate about $4.85 billion of gross profit during 2025 on a monthly active user base of about 57-58 million, implying an ARPU of $84. In 2025, Venmo’s P2P volume is expected to be close to $300 billion (nearly 17% of PayPal’s total), up from just $7.5 billion during 2015 (less than 3% of total). Unless funded with a credit card, Venmo makes nothing on a P2P transfer. As a result, the inclusion of Venmo’s P2P volume artificially depresses PayPal’s take rate. Below is a chart that excludes all P2P4 from TPV when calculating PayPal’s take, transaction expense and transaction and credit loss rates. While the lines are still downward sloping, the declines are more gradual:

Apple Pay. Although Apple is tight-lipped about Apple Pay specifics, widely cited estimates suggest it is as large, or larger, than PayPal in terms of active users and acceptance. At the end of 2024, on its 10-year anniversary, Apple disclosed that Apple Pay had “hundreds of millions” of consumers and was accepted at checkout by “millions of websites and apps” and in “tens of millions of stores” worldwide. Finally, during its most recent quarter, Apple reported Apple Pay active users grew by double-digits on a year-over-year basis, suggesting strong growth at scale. By comparison, PayPal reported 438 million active accounts across its brands as of September 30, up just 1%, including an estimated 35 million merchant accounts and more than 400 million consumers. I believe the proliferation of Apple Pay has had a significant negative impact on PayPal’s performance. With similar, or larger, scale and better ease of use, which will be exacerbated by the slow rollout of PayPal’s modern checkout experience, it’s unlikely PayPal will regain the upper hand against Apple Pay any time soon, if ever.

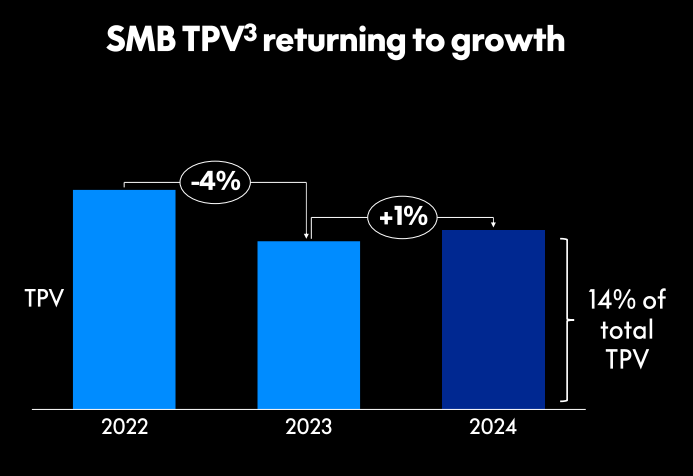

The Shopify Juggernaut. The most successful payments companies today provide commerce platforms for small businesses. A commerce platform is software that manages business operations (i.e., website creation, inventory management, scheduling and payroll, loyalty and rewards, and analytics, among others); integrates payment processing; and offers financial services, including lending. Although Toast and Square have had success with this strategy in a highly competitive in-person environment, Shopify has absolutely dominated among small online sellers, as PayPal ceded the playing field and lost out on a significant amount of highly profitable unbranded processing volume. I’ve long believed PayPal had the resources to build or buy commerce tools for its small business customers, drawing them closer and keeping out competitors like Shopify. They chose not to, which I view as a crucial misstep. Instead, PayPal focused on incentivizing consumers to make more branded checkout transactions. But this is a losing proposition, in my opinion, as PayPal lacks differentiation from other digital wallets, including Apple Pay, making it likely incentives will be an ongoing requirement for consumers to choose PayPal over alternatives, rather than a one-time investment with a high ROI.

According to PayPal, SMB TPV5 declined from about $243 billion during 2022 to $235 billion in 2024 (14% of PayPal’s total TPV). Over a similar time frame, Shopify’s reported GMV on its platform, which serves primarily small online sellers, grew from $197 billion to more than $292 billion, a 48% increase.

Adyen and Stripe provide value-added processing to enterprise customers and small businesses through integrations with platforms, including vertical software and marketplaces (Adyen now powers payments for most small businesses selling on eBay’s platform). They compete directly with PayPal’s Braintree. Although Braintree has grown its volume significantly, its transaction margins are relatively small compared to branded checkout, exacerbated by Braintree’s ill-fated decision a couple of years ago to aggressively lower price to capture share. While the reversal of those pricing actions and the attrition of unprofitable volume have contributed to PayPal’s recent transaction margin improvements, it is unclear how much, if any, ongoing benefit they will provide.

PayPal’s Current Composition

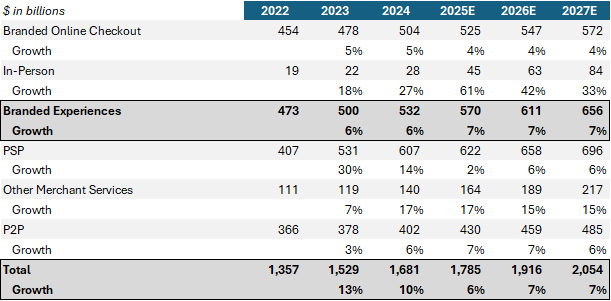

Below are my estimates for the current composition of PayPal’s total payment volume TPV, transaction revenue, and take rate. Please note these estimates are based on PayPal’s earnings releases, presentations, and commentary from conference calls. Where possible, I note the sources of information:

Pay Now

Includes branded online checkout across PayPal, eBay and Venmo (i.e., Pay with Venmo). In 2024, Pay Now TPV was $471 billion, including $434 billion for PayPal, $29 billion for eBay and $8 billion for Venmo. In the U.S., listed fees for PayPal Checkout and Pay with Venmo are 3.49% plus $0.49 per transaction. Fees for international markets are lower, and fees for enterprise merchants are individually negotiated and significantly lower than listed rates. For 2024, I estimate a blended take rate of 2.68% on Pay Now TPV, including 2.75% for PayPal and Pay with Venmo and 1.65% for eBay.

In 2025, I estimate Pay Now TPV will grow about 3% with 2.5% growth for PayPal and 44% growth for Pay with Venmo. eBay volume is expected to decline slightly. For 2025, I estimate a blended take rate of 2.64% on Pay Now TPV, down 4 bps, and primarily reflecting a 5 bps decline for PayPal and Venmo to 2.70%.

Pay Later

PayPal’s Pay Later (BNPL) TPV was $33 billion in 2024, per the company’s Investor Day Presentation. At the end of 2024, PayPal announced an increase in its merchant fees for BNPL, increasing from 3.49% plus $0.49 per transaction to 4.99% plus $0.49. According to PayPal, average order value (AOV) for BNPL is “quite small compared to some of the others.” Affirm reports an AOV of approximately $275 while independent research has shown the AOV across all U.S. BNPL is about $150. On its Q4 2022 earnings presentation, PayPal reported $20.3 billion of BNPL volume on 147 million transactions for 2022, implying an AOV of about $140. Using listed fees prior to the increase, this implies a take rate of 3.85%. I use a take rate of 3.75% for 2024, assuming only a modest amount of custom pricing and incentives.

For 2025, I estimate BNPL TPV of $40 billion, implying about 20% growth. For the take rate, I assume 4.5%, which is 85 bps below the new listed rate (4.99% plus $0.49 per transaction on an AOV of $138), which considers a couple factors: (1) not all merchants will pay this rate, some enterprise customers will pay less; and (2) cash back rewards are accounted for as contra-revenue, reducing the take rate.

Branded Online Checkout

Pay Now and Pay Later comprise PayPal’s Branded Online Checkout category. For 2025, I estimate Branded Online Checkout TPV grows 4.2%, which incorporates about a 200 bps slowdown in Q4.

In-Person

I estimate 2024 In-Person TPV of $28 billion, including $13 billion for the Venmo debit card and $15 billion from the combination of the PayPal debit card, QR codes and tap to pay. I assume a take rate of 0.9% for debit cards, in-line with Chime’s, which is publicly reported, and something above 2% for QR codes and tap to pay, which I believe are the smallest portion of In-Person TPV.

For 2025, I estimate Offline TPV grows about 60% to $45 billion, consistent with PayPal’s commentary through the first three quarters. I assume a similar take rate across all categories, with higher growth in lower yielding debit cards resulting in a blended take rate of 1.17%, down 6 bps.

Branded Experiences

Branded Online Checkout and In-Person combine to represent Branded Experiences. I expect Branded Experiences TPV growth to accelerate to 7.1% during 2025, led by strong In-Person growth.

Payment Service Provider (PSP)

Includes Braintree and PayPal’s unbranded processing. In 2024, PSP TPV was $607 billion, including $572 billion for Braintree and $35 billion for PayPal’s unbranded processing. My estimate for Braintree’s take rate is 1.85%. According to PayPal’s 10-K, Braintree’s transaction revenue increased by approximately $1.3 billion in 2024. Separately, PayPal reported that PSP TPV increased 14% during 2024. Assuming a similar growth rate for Braintree (which accounted for more than 90% of PSP TPV in 2024), implies Braintree TPV of $502 billion in 2023 and $9.3 billion of Braintree transaction revenue. Applying a similar 1.85% take rate to Braintree’s 2024 TPV of $572 billion implies transaction revenue of $10.6 billion, a $1.3 billion increase over 2023. For PayPal’s unbranded processing TPV, I assume a take rate of 2.65%, which reflects a higher proportion of TPV from small and mid-sized businesses, or SMBs.

After falling in Q1, being flat in Q2, Braintree’s TPV growth turned positive in Q3 2025, increasing at a mid-single-digit rate, with further improvement anticipated for the final quarter. For 2025, I estimate PSP TPV to grow about 2.5% with a slightly smaller increase for Braintree and a roughly mid-single digit increase for PayPal unbranded processing. I expect the blended take rate to fall slightly, by 3 bps, as enterprise merchants make up a greater percentage of the volume mix, partially offset by price rationalization and the attrition of lower yielding and less profitable Braintree TPV.

Person-to-Person (P2P)

Includes Venmo, PayPal and Xoom TPV. In 2024, P2P TPV was $402 billion (reported by PayPal), including $272 billion for Venmo (from Investor Day presentation). The remaining $130 billion is attributable to PayPal and Xoom. In 2016, the year after Xoom was acquired by PayPal, TPV (i.e., sending volume) was about $8 billion. Since the quarters immediately following the acquisition, Xoom has been sporadically mentioned, except for in Q1 2024, when CEO Alex Chriss characterized the business as “stagnating”. For 2024, I assume Xoom generated $15 billion of TPV which implies a mid-to-high single-digit compound annual growth rate since 2016, with greater growth in the early years, followed by a slowdown, or decline, more recently. For the take rate, when a Venmo or PayPal domestic P2P transaction is funded with a debit card or checking account, there is no fee for the consumer. Only when it crosses borders (for PayPal only, Venmo is not eligible) or is funded by a credit card, is the consumer required to pay a fee. I assume the vast majority of Venmo and PayPal P2P TPV do not require a fee, and only a low single-digit percentage does, resulting in a blended take rate of less than 10 bps. For Xoom, I use a take rate of 2.5%, which was publicly reported before it was acquired by PayPal.

For 2025, I estimate P2P TPV of $430 billion, implying 7% growth with about 10% growth for Venmo, low single-digit growth for PayPal, and declining TPV for Xoom. I assume similar take rates, yielding a blended take rate of 16 bps.

Other Merchant Services

Other Merchant Services consists of payouts, invoices, and point-of-sale solutions, among others. I believe payouts make up the largest percentage of Other Merchant Services TPV, are the fastest growing, and carry among the lowest take rates. In 2024, Other Merchant Services TPV was $140 billion. My take rate estimate of 1.10% was arrived at by process of elimination, but seems realistic, in my opinion, reflecting a take rate of 50-75 bps for payouts and above 2% for invoices and point-of-sale solutions (Zettle, which is PayPal’s point-of-sale solution, reported a take rate of 2.75% at the time of its acquisition).

For 2025, I estimate Other Merchant Services TPV at $164 billion, implying 17% growth. Since payouts are frequently called out as a contributor to a lower take rate, I believe their growing share of Other Merchant Services TPV will cause the blended take rate to fall 6 bps in 2025 to 1.04%.

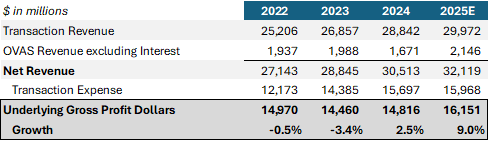

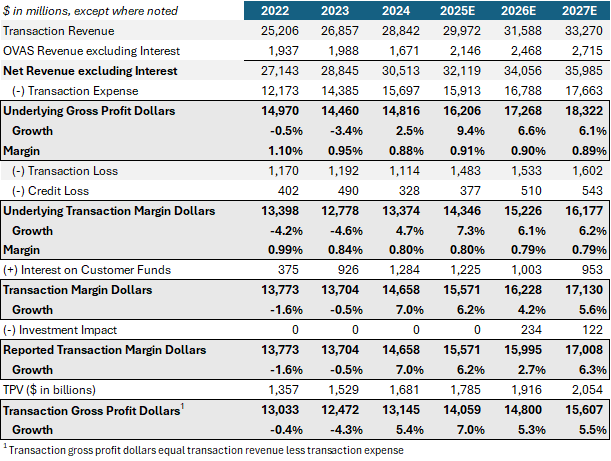

2025 Results

Although PayPal’s underlying 2025 performance appears stronger than the market gives it credit for, there are some tailwinds that helped in 2025 that are unlikely to recur:

PayPal guides to TM$, which it defines as net revenue less transaction expense and transaction and credit losses. Conversely, companies such as Toast, Block’s Square, and Shopify are typically evaluated on gross profit, which is net revenue less transaction expense, which is primarily interchange, network, and processing fees, and are significant for payment service providers like PayPal.

While PayPal’s transaction expense and credit losses are moving in the right direction, transaction losses are not. In Q3, PayPal’s transaction loss increased 50% to $397 million, after a 47% increase during Q2. In its filings, PayPal attributed it to “an increase in losses driven by fraud incidents from our PayPal products and services (and to a lesser extent, from our Venmo products and services).” In the company’s Q3 presentation, PayPal noted a 3 bps increase in the transaction loss rate, “driven by higher transaction loss provisions, including impact from the temporary service disruption in August.” It certainly appears these elevated loss rates could prove temporary, turning from a headwind this year, to a tailwind next year.

If we focus on PayPal’s gross profit dollars, which I define as net revenue less transaction expense, we see that growth in this measure was about 9% during Q3, better than the 6% increase in transaction margin dollars, and at an attractive absolute level, in my opinion. Taking it a step further, if we exclude interest on customer funds and the one-time benefit to TM$ during Q2, the trend in gross profit dollars from Q3 2023 (-5%) to Q3 2025 (+10%) is essentially straight-up:

As mentioned earlier, 2025 had more tailwinds than headwinds, in my opinion. For the full year, I estimate gross margin dollars excluding interest on customer funds and the one-time Q2 benefit will increase 9%, or $1,335 million:

Of the $1,335 million increase, I believe nearly 60% is attributable to the BNPL fee increase ($300 million) and growth in Other Value-Added Services revenue excluding interest on customer funds, which is expected to be 28%, or $475 million. Excluding both tailwinds, growth would be just 4%. If we exclude just the BNPL fee increase, which will clearly not recur, growth would be 7%.

2026, 2027 and Beyond

PayPal’s management has struck a more cautious tone in recent conversations. At the UBS Conference on December 3, CFO Jamie Miller said this about the current environment:

“…what we’re expecting at this point is that the fourth quarter branded checkout will grow at least couple points lower than what we saw in the third quarter.”

And this about 2026:

“A lot of people have asked us, okay, how should I think about this? How should I think about your financial profile? What I would say is that we expect that the investments we're going to make, mostly in transaction margin dollars, but some in OpEx [operating expense], to bring slower growth to transaction margin dollar and earnings per share growth in '26 versus what we had in '25, still positive growth, but at a much slower rate.”

In terms of the investments—which PayPal believes will negatively impact TM$ growth by 1 to 2 points during 2026—they are spending to “incentivize” and “habituate” consumers, and include co-marketing with merchants and partners, like the Big 10 and Big 12 for Venmo’s college campaign, offering cash back and other rewards for BNPL and its debit card programs, and paying to have the PayPal checkout button placed more prominently on the paysheet, or moving the Pay Later (BNPL) button upstream (i.e., before checkout, so consumers know it’s an option while shopping). Other investments will be made on agentic commerce, but PayPal acknowledged returns on this spending are unlikely to materialize over the near-term.

Modeling 2026 and 2027

For 2026 and 2027, I’ve taken the approach of modeling out the business before any impact from planned investments, which I apply on a consolidated basis afterward. Key TPV assumptions for 2026 and 2027 are as follows:

PayPal Pay Now Online Checkout TPV grows 2.5% in both 2026 and 2027, similar to its growth rate in 2025

BNPL TPV grows slightly more than 20% in 2026 and 2027, to $48.5 and $58.5 billion, respectively

Pay with Venmo TPV grows 35% in 2026, a roughly 9-point slowdown from 2025, followed by 29% growth during 2027

In-Person TPV grows in the low-40% range in 2026—down from more than 60% growth in 2025—followed by 33% growth in 2027

Braintree TPV grows 6% in 2026 and 2027, up from slightly more than 2% in 2025, and PayPal unbranded processing grows 3.5% in both years

P2P TPV growth of 7% in 2026—led by 9% growth for Venmo—and less than 6% growth in 2027 with 7.5% growth for Venmo

Other Merchant Services TPV growth of 15% in 2026 and 2027, down slightly from 17% growth in each of the last two years

For net revenue and take rate—which is before any impact from investments that will act as contra-revenue—my assumptions are:

A 4 and 5 bps decline in Online Branded Checkout take rate during 2026 and 2027, respectively, excluding Pay Later, whose take rate I expect to remain stable at 4.5% in both years

A 5 bps decline in take rate for both 2026 and 2027 across PayPal Pay Now Online Checkout and Pay with Venmo due to a growing mix of enterprise merchant volume

A 1 and 1.5 bps decline in Braintree’s take rate during 2026 and 2027, respectively, reflecting PayPal’s ongoing price discipline, partially offset by a growing mix of enterprise merchant volume

Stable take rates across all other product categories

Other Venmo Fees grow less than 8% in both 2026 and 2027, roughly in-line with P2P growth

OVAS revenue, excluding interest on customer funds, grows 15% in 2026, down from 28% growth during 2025, and 10% in 2027, and

Interest on customer funds of $1,003 and $953 million in 2026 and 2027, respectively, down from $1,225 million in 2025, reflecting low single-digit annual growth in average customer balances and a roughly 75 bps decline in the effective rate earned in 2026, and a 25 bps decline in 2027

For key expense categories, I assume:

Stable transaction expense rates across all product categories, with the mix shift in TPV driving a 1.8 bps decline in the consolidated transaction expense rate to 87.6 bps in 2026, and a 1.6 bps decline in 2027 to 86.0 bps

The transaction loss rate falls to 8.0 bps in 2026, down 0.3 bps from 2025, and to 7.8 bps in 2027—this could prove to be conservative as the transaction loss rate was only 6.6 bps in 2024 (but 7.8 bps during 2023), and

The net charge-off rate returns to its recent historical average of 2.4 bps in 2026 and 2027, up from 1.9 bps during 2025

On a reported basis, my assumptions yield TM$ growth of 2.7% in 2026, assuming a 1.5-point headwind from investments. In 2027, assuming investment levels are halved—a 75 bps headwind to TM$ growth—implies TM$ growth of 6.3%.

Future Opportunities

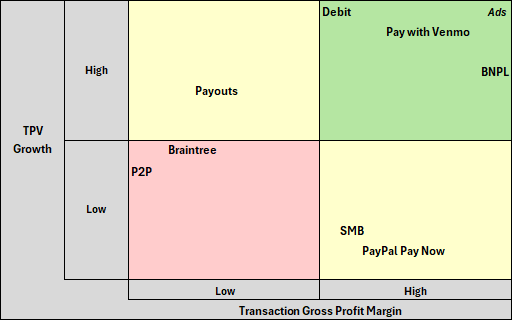

My Transaction Gross Profit Scorecard lays out PayPal’s TPV opportunities by growth and margin profile:

I’m going to focus on what I believe are the most tangible opportunities for PayPal over the near to medium-term:

Monetize Venmo

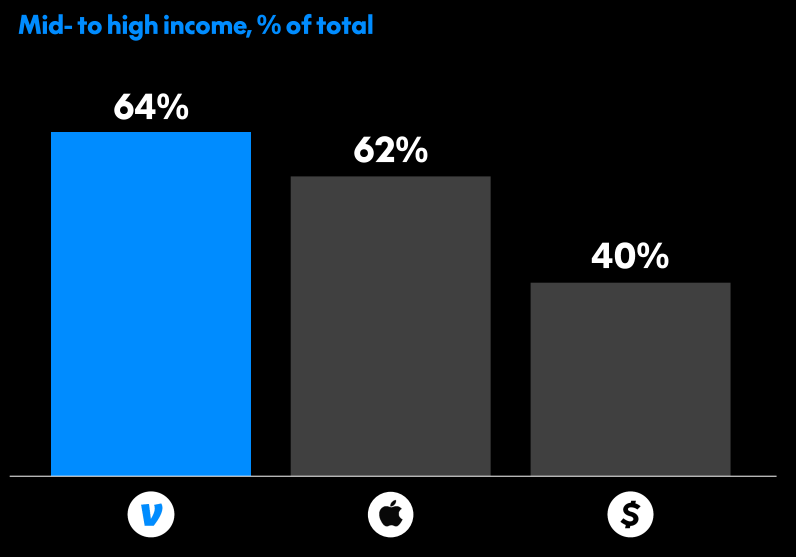

Before discussing the opportunities, there are impediments to substantially monetizing Venmo. The greatest is that Venmo’s user base is more affluent, making it unlikely a significant percentage will establish a primary financial relationship with Venmo:

However, Venmo is making inroads with younger adults and teens, including college students, providing an opening. Secondly, a meaningful portion of Venmo’s revenue comes from high-margin instant transfer fees, which are growing more slowly. Although attaching debit cards and Pay with Venmo will be advantageous for PayPal over the long term, if instant transfer fees are displaced over the near term, it could be a bumpy transition.

Now on to the opportunities. I see three. First, drive more funds in, including loyal direct depositors, who make up less than 5% of monthly actives today. Some of this is being done through payouts, powered by PayPal, into the Venmo ecosystem. Second, attach more debit cards and sign up more Pay with Venmo users. Currently, only 5-10% of monthly actives have a debit card and use Pay with Venmo. By comparison, 45% of Cash App’s monthly actives have attached a debit card. To entice more users, PayPal is offering attractive rewards, including cash back. Third, offer additional products to attract more customers: crypto and stock trading, high-yield savings accounts, and short-term liquidity products. Currently, Venmo does not offer savings accounts or short-term liquidity products, but will be able to do so after securing a banking charter.

Pay with Venmo is the highest-margin opportunity within Venmo, as PayPal earns similar take rates to branded online checkout but incurs much lower transaction expense rates, due to a significant percentage of transactions being funded with existing Venmo balances. Even though the 0.9% take rate for the Venmo debit card is well below the company’s average, there is essentially no transaction expense associated with it, making it accretive to the company’s overall transaction gross profit margin.

Instead of going product by product, I think it’s more useful to benchmark Venmo’s monetization to Cash App:

No, I don’t believe Venmo will ever achieve parity with Cash App. I do believe, however, that Venmo can close the gap. For example, if Venmo grows its monthly active users by a mid-single-digit rate through 2028—to about 71 million average users in 2028, up from 62 million at the end of 2024—and achieves 50% of Cash App’s monetization rate ($42), it implies net revenue of nearly $3 billion for Venmo in 2028, up from an expected $1.7 billion in 2025.

Accelerate BNPL

With significant acceptance (nearly everywhere PayPal is), a large consumer base, trusted brand, and blue-chip funding partners, there is no reason PayPal should be lagging in BNPL, yet it is. Although volume growth of 20% seems good, it trails the industry—which has grown in the mid-to-high 20% over the last two quarters—and most of the other publicly-traded BNPL providers:

Further, in the U.S., I estimate PayPal has less than 10% of the BNPL market6. PayPal’s action plan for accelerating BNPL is to offer rewards and move the Pay Later button upstream, making consumers aware of this option while shopping and achieving parity with other BNPL providers, which are typically displayed by an item for purchase. Although this will cost money—for rewards definitely, and in certain cases for placement—I think it’s a worthwhile investment, as BNPL TPV is the most profitable for PayPal from a transaction gross profit margin perspective. To demonstrate, if instead of 20% growth in 2026 and 2027, I assume 25% growth for BNPL TPV, leaving all else equal would result in PayPal’s reported TM$ being 0.7% higher by 2027.

Accelerate Merchant Lending

One of the more interesting aspects of PayPal’s recent press release announcing its application for a U.S. bank charter was the prominence of merchant lending. While becoming a bank would make lending to SMBs more efficient and profitable for PayPal, I would like to see more loans issued, whether by PayPal as a bank or in conjunction with its current partners. According to the press release, since 2013, PayPal “has provided access to over $30 billion in loans and working capital to more than 420,000 business accounts worldwide.” While this looks impressive on paper, consider that in just the past five years, Square has originated nearly $25 billion in loans to its SMB customers, including almost $7 billion in 2025 alone. In addition to Square, Shopify, Toast, and nearly all other commerce platforms provide lending to their SMB customers. Not only does this generate high-margin revenue with strong repayment visibility based on processing history, but it also serves as a powerful retention tool. With PayPal lacking other commerce tools, particularly business management software, it is crucial that it provides lending as a way to acquire and retain more SMB customers.

As always, thank you for reading, and if you enjoyed reading this, please consider sharing, liking, commenting or subscribing!

Disclosure: I do not hold a position in PayPal. Of the companies mentioned in this report, I am long Visa and Block. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.

Underlying transaction margin dollar equals transaction margin excluding interest on customer funds

Transaction gross profit equals transaction revenue less transaction expense

Transaction margin equals total net revenue less transaction expense and transaction and credit losses divided by TPV

Venmo and PayPal P2P and Xoom TPV

SMB TPV represents TPV across branded checkout, unbranded processing and other merchant services

About 30% of PayPal’s BNPL TPV is from the U.S. In Q3, I estimate about $3 billion of U.S. TPV for PayPal’s BNPL, about 8.5% of the more than $34 billion for the entire market

Bob, thanks for this. Couple questions: there is so much detail here, what is the top 1 or 2 things you’re watching in 2026?

What are your thoughts on the opp. with PayPal World and the Advertisement platform both launching between now and end of Q1?