Adyen N.V. (ADYEN)

Powering enterprise payments

Investment Brief

How Adyen wins. Imagine you’re a large enterprise. You operate in the U.S. and Europe but plan to expand into Latin America and, eventually, Asia-Pacific. Initially digital-first, your long-term ambition is to open physical locations and sell face-to-face. Your complex payment needs require multiple solutions from legacy providers. But Adyen’s modern payments engine, built entirely from scratch, enables a business to sell anywhere, across any channel, and accept virtually any payment method. All from a single platform, backed by powerful insights derived from Adyen’s extensive data. And here’s the best part. In addition to simplifying your payments infrastructure, Adyen delivers revenue benefits and cost savings, including higher conversion and approval rates and lower fraud, network and interchange fees.

Built-in growth. Adyen partners with some of the best and fastest growing companies in the world:

This is a sample of Adyen customers, not necessarily the largest, selected because of their publicly discussed status and consistently available data.

Attrition is less than 1%. Even without new customers or increased wallet share among existing customers, Adyen’s volume growth could hit double-digits:

Contrast that with legacy providers. Those serving SMBs may see churn rates up to 15%, making it difficult to grow meaningfully year-in and year-out. While enterprise customers are less likely to fail or leave, those focused in-store may see sales grow only in the low single-digits, or less.

Assuming moderate wallet expansion, Adyen’s processed volume could grow at a 17% compound annual rate through 2029 from existing customers alone:

Ready to (re)scale? Despite significant net revenue growth since 2018 (up 586%), Adyen’s 2025 EBITDA margin will be flat to 2018:

Why? Adyen hired aggressively in 2022 and 2023 even as net revenue growth slowed from 46% (2021) to 22% (2023). Additionally, growth in people cost1 per average employee rose 13% and 14% during 2022 and 2023, respectively. The result: people cost rose from 24% of net revenue in 2021 to 36.5% of net revenue in 2023. Although growth in the number and cost per employee is expected to slow during 2024 and 2025, people costs are still expected to end 2025 at more than 32% of net revenue, well above the mid-20% range prior to 2022.

Even as Adyen follows a similar playbook to high-growth peers by entering a digestion phase after rapid headcount growth, its cumulative employee increase since 2019 surpasses all high-growth peers, some by a healthy amount:

From 2018 to 2025, Adyen’s net revenue per employee is expected to rise by 16%. In comparison, U.S. inflation, as measured by the CPI, is projected to exceed 30%, while Adyen’s per-employee people cost will increase by roughly 50%.

Adyen’s net revenue2 per employee trails Block and Shopify:

All of this is a roundabout way of saying Adyen over hired. Does that mean there will be layoffs? No. However, I do believe the company could slow its pace of hiring below the implied annual amount of 400-450 people. My valuation work assumes Adyen hires 400 people per year (starting in 2026) and costs per employee rise about 3% annually. This yields a 61% margin by 2034.

Earnings roller coaster. Adyen reported half-year results on August 14. The major headline was that the company now sees net revenue growing around 20% for the full year, a reduction from its prior forecast for a ‘slight acceleration’ versus the 23% growth achieved in 2024. The reason: tariffs are impacting some large online retail customers based in Asia-Pacific that sell into the U.S. (i.e., Temu and Shein). Although the stock originally fell about 20%, it recovered most of the drop in the same trading day and nearly all of it within a week. Currently, the stock sits about 5% below its pre-earnings level.

Critically analyzing the results, even after excluding the 2% negative tariff impact on net revenue, Adyen’s current underlying guidance (of 22% net revenue growth for 2025) falls short of prior expectations, which implied at least 24% net revenue growth. Overall, I’m surprised the stock recovered as much as it did.

Cash App and eBay. The movement of a large amount of lower yielding processed volume is obscuring Adyen’s underlying performance. Reported processed volume growth is expected to be 10% in 2025, down from 33% in 2024. On an underlying basis3, I estimate processed volume growth of 27% in 2024 and 25% in 2025. Here’s my best guess on the details:

In Q3 2023, Adyen started processing domestic inflows to Cash App, such as debit card funding transactions. Volume ramped in Q4 2023, remained steady in H1 2024, then declined in H2 2024. In H1 2025, I believe Adyen did not process a material amount of domestic Cash App inflows.

In 2023 and 2024, Adyen processed an estimated 55-65% of eBay’s GMV, nearly all not handled by PayPal. In Q1 2025, Adyen’s share of eBay’s GMV significantly decreased, likely due to eBay’s new global acquiring partnership with Checkout.com. In Q2 2025, Adyen processed an estimated 10-15% of eBay’s GMV.

My thoughts on the stock and why I’m considering an investment in Adyen. I consider Adyen, Toast and Shopify to be the highest-quality non-network businesses in Payments. Of the three, Adyen has the least demanding valuation. In fact, I believe Adyen is slightly undervalued today, which cannot be said for the other two. But investing is about allocating finite resources to your highest conviction ideas. Under that framework, I still prefer Fiserv first and Global Payments second over other names in Payments. However, I’m considering an investment in Adyen, because: (1) it’s a terrific business, trading at what appears to be a reasonable price; and (2) it provides something of a hedge against my significant position in Global Payments. Let me explain:

I estimate the new Global Payments4 will generate about 36% of its revenue from the Integrated and Embedded channel, akin to Adyen’s Platforms pillar. In my view, Adyen and Global Payments are targeting different parts of the market. While Adyen is focused on the largest platforms and SaaS companies, evidenced by its 32 customers processing over €1 billion annually, Global Payments serves over 7,000 software partners that collectively generate $600B of volume from 1.2MM merchants, implying average volume of about $85 million per software partner and $500k per merchant:

This is evidenced by the disparity in net take rates. For Global Payment’s Integrated and Embedded channel, I estimate a net take rate of 45-50 bps versus a reported take rate of about 12 bps for Adyen’s Platforms pillar over the last twelve months. If Adyen successfully pursues the longer tail of smaller vertical SaaS companies, it would be a positive development for Adyen and a negative outcome for Global Payments. Although this is not my base case, if I am wrong (which is certainly possible), owning Adyen would act as a hedge against my significant position in Global Payments.

Risks

Volume fluidity. Enterprise customers work with multiple payment processors. Even though churn is negligible, volume can move away from Adyen in an instant. Whether it be for pricing reasons or performance issues. While I believe Adyen has increased its wallet share over time, enterprises’ insistence on maintaining flexibility likely caps Adyen’s terminal wallet share opportunity.

Intense competition. As always, competition in payments is fierce, especially in the U.S. And although Adyen is well-equipped to maintain its winning ways, several companies pursue Adyen’s target markets aggressively, including Stripe, Checkout.com, Braintree, Worldpay, J.P. Morgan, Fiserv and Global Payments. While Stripe, Checkout.com and Braintree have similarly comprehensive and modern platforms for online payments, the other companies possess similar capabilities but generally fail to deliver them on a unified platform. If they can do so, it could shift the competitive balance.

Adyen’s premium positioning may be susceptible during downturns. Adyen is not the low-cost provider but arguably delivers the lowest total cost of ownership to merchants. Nonetheless, customers may choose to move volume away from Adyen to save money during a downturn.

Conservative capital allocation. Adyen has retained cash on its balance sheet to maintain a strong credit rating, supporting its embedded finance strategy for platform customers. If growth slows and valuation multiples decline, investors may push for a capital return policy, including share buybacks, which Adyen may or may not decide to pursue.

Embedded finance strategy carries risks. Pursuing an embedded finance strategy could distract from Adyen’s core mission of powering payments for complex enterprises and platforms. Further, the expansion of banking features, like lending and accounts, may alter Adyen’s capital requirements, expose the company to credit losses, and dilute the company’s premium multiple.

The Numbers

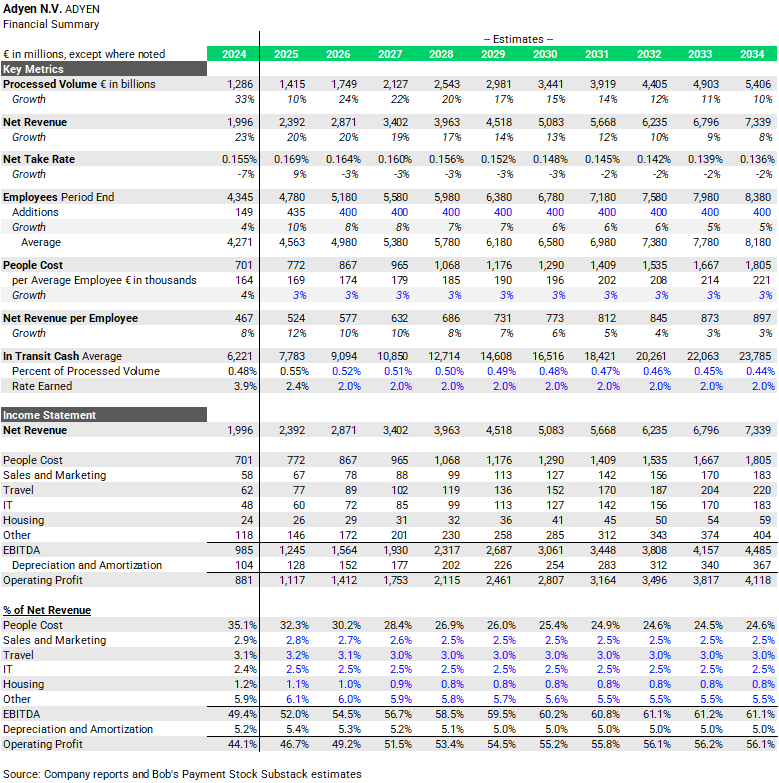

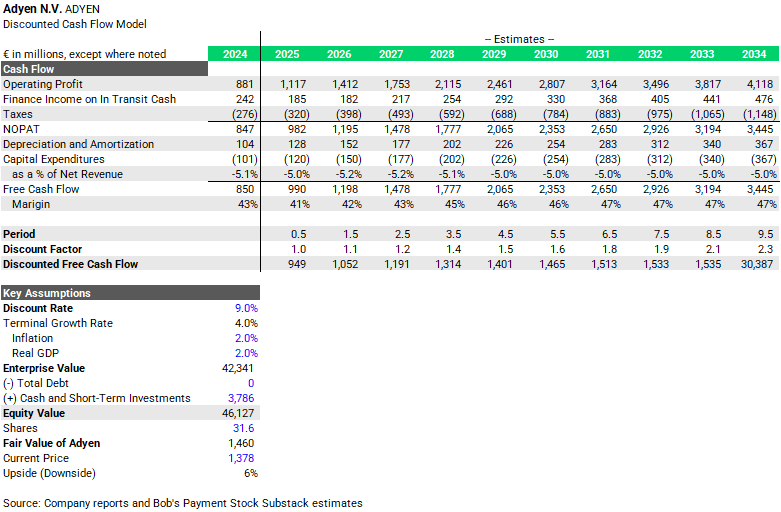

My fair value for Adyen is €1,460 per share. My key assumptions are:

Processed volume. I estimate’s Adyen’s underlying processed volume will grow at a compound annual rate of 17% from 2024-2034, with 21.5% growth in the first five-year period (2024-2029), followed by about 13% growth from 2029-2034. I believe growth will be strongest in Platforms, followed by Unified Commerce, then the Digital pillar. New client wins will be more impactful in Unified Commerce and Platforms as the company already has a sizable share in Digital.

Net take rate. Starting in 2026, I assume Adyen’s net take rate declines by about 3% annually due to the company’s tiered pricing strategy and a greater contribution from Platforms, which carries the lowest take rate for Adyen. However, I do believe Adyen’s take rate in Platforms will expand from its current level of about 13 bps (during Q2 2025) as eBay becomes a smaller part of processed volume, Adyen signs smaller (but still large) platform customers at higher net take rates, and the company penetrates its embedded finance offering, increasing monetization.

Net revenue. My processed volume and net take rate assumptions yield compound annual net revenue growth of 14% from 2024-2034.

EBITDA margin. I believe Adyen will reach an EBITDA margin of about 61% by 2032 and remain stable thereafter. People costs are expected to fall to 25% of net revenue by 2034 while non-personnel costs reach 14.3% of net revenue, down only modestly from 15.5% during 2024.

In-transit cash. I assume Adyen’s in-transit cash falls to 0.44% of processed volume by 2034, compared to an historical average of 0.56%. I model a long-term yield on in-transit cash of 2%.

For my DCF model, I assume:

A tax rate of 25%

Depreciation and amortization and capital expenditures equal 5% of net revenue throughout most of my forecast period and

A discount rate of 9%, which reflects Adyen’s strong financial position and organic approach to operating the business, which lessens the likelihood of disruptive impacts from major acquisitions

Company Overview

Adyen delivers robust commerce experiences to enterprise and platform customers through a powerful payments engine:

A comprehensive platform supporting e-commerce, mobile, and in-store transactions, covering hundreds of payment methods, including card schemes, digital wallets, buy now pay later, and bank transfers, in most major geographies across the world.

One size fits all. There are no carveouts or customizations, nor separate systems for e-commerce, in-store payments, or geographies. A single platform benefits Adyen and its customers. For Adyen, it simplifies and speeds product development and release. For both, it reduces costs and complexity while enabling efficient data capture and utilization.

Adyen eliminates third parties from payment transactions. Besides offering gateway services, processing, settlement, and risk management, Adyen’s local acquiring licenses and banking charters allow it to bypass financial intermediaries, simplifying operations for customers by reducing the number of vendors, speeding up merchant payouts, and supporting a fully controlled embedded finance offering.

Adyen increases revenue and lowers costs for merchants:

By supporting all payment methods, Adyen increases the likelihood customers complete transactions, boosting conversion.

Adyen automatically updates payment credentials, ensuring subscription payments are processed.

By minimizing intermediaries, Adyen enhances e-commerce approval rates.

Adyen uses its extensive data to enhance fraud detection and optimize transaction presentation to issuers for approval.

Adyen optimizes routing to secure the lowest-cost method without compromising performance.

Adyen separates its business into three commercial pillars:

Digital was the company’s original focus, serving enterprises that sell exclusively online, or in-app. Frequently discussed customers include Netflix, Spotify, Uber, Booking.com, Airbnb, Temu and Shein.

The company’s Unified Commerce offers support for enterprises that sell across digital and in-store channels. Frequently discussed customers include LVMH, McDonald’s and Nike.

Adyen reaches small businesses and sellers through Adyen for Platforms. eBay was the anchor client, but the company now has 32 customers processing over €1 billion annually, including numerous vertical software companies.

Geography. Adyen still generates the majority of its net revenue from its home market of Europe (EMEA), but North America has grown in importance, accounting for 27% of Adyen’s net revenue in 2024, approximately doubling its representation since 2018.

Land and expand. Adyen employs a sales team to attract new customers and account management teams to grow business with existing clients. The company uses superior performance and tiered pricing to gain greater wallet share. Adyen processes only about 30% of its customers' total volume, offering significant potential for future growth.

A key tenet of Adyen’s long-term growth plan is to offer embedded finance solutions to attract platforms and serve their small business customers, including card issuing, lending and accounts, all facilitated by the company’s banking charters, providing Adyen full control over as opposed to a partner model employed by most FinTechs.

Investment Checklist

Below is an evaluation of Adyen using my Investing Checklist.

Disclosure

Adyen reports processed volume and net revenue across its Digital, Unified Commerce, and Platforms commercial pillars. It provides context to gauge underlying performance when significant customer changes occur, like recently with Cash App and eBay. Under IFRS, Adyen must report results semi-annually, but it recently began providing quarterly updates with limited financial releases and conference calls, a positive development, in my view.

Adyen’s earnings quality is of the highest order. The company’s results are free from restructuring charges, acquisition and integration costs, and ongoing legal expenses. There are no adjusted measures of profitability or earnings. Stock-based compensation is minimal.

Growth

From 2019 through 2024, Adyen’s processed volume, net revenue and EBITDA grew at compound annual rates of 40%, 30%, and 25%, respectively.

Adyen demonstrates favorable growth characteristics:

Growth is driven solely by processing higher volumes, mainly from existing customers, typically accounting for up to 80% of Adyen's annual growth

Adyen does not rely on price increases for net revenue growth. Instead, it offers tiered pricing (lower prices at higher volume levels) to encourage customers to do more business with Adyen

Adyen does not rely on acquisitions for net revenue growth, preferring to build products organically or partner when necessary

Adyen has reduced its customer concentration significantly. It’s top ten merchants represented 12% of revenue in 2024, down from 53% in 2017

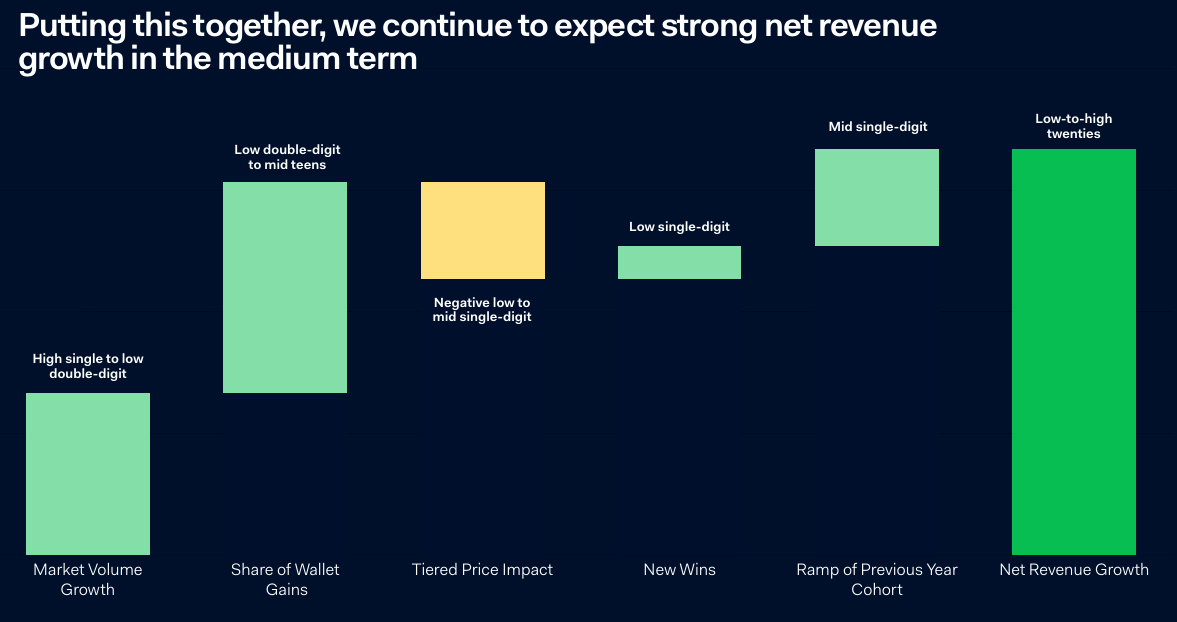

Adyen aims to grow net revenue annually between the low-20% and high-20%, up to and including 2026, including positive contributions of about:

10% from customer or market volume growth

12% from expanding wallet share among tenured customers (i.e., more than two years old), and

7% from customers less than two years old (Adyen has stated processed volume for a customer increases significantly during the second year)

Offset by a 4% decline from the company’s tiered pricing impact.

Profitability

Although Adyen’s profitability has declined due to increased hiring, its anticipated 2025 EBITDA margin of 52% will be among the highest in Payments, reflecting the benefits of its single-platform approach. Additionally, while I've focused on the go-forward opportunities to leverage people costs, Adyen has significantly improved efficiencies in non-personnel costs over time:

Free Cash Flow

From 2018-2024, Adyen generated €3,428MM of adjusted free cash flow, representing 104% of the company’s reported net profit. I calculate adjusted free cash flow as net cash flow from operating activities, as defined by IFRS, adjusted for the change in payables to and receivables from merchants and financial institutions minus purchases of plant and equipment and the capitalization of intangible assets:

Financial Health

As of June 30, 2025, Adyen reported cash and cash equivalents of €12,521MM, which includes €8,735MM for a current liability of payables to merchants and financial institutions, implying cash available to Adyen of €3,786MM. I refer to the €8,735MM due to merchants and financial institutions as in-transit cash, similar to float reported by payroll companies. Adyen has no debt. In-transit cash has averaged about 0.56% of the company’s processed volume since 2018.

Returns

Over the last twelve months, Adyen generated a return on tangible assets of 52%, among the highest in Payments. I define return on tangible assets as NOPAT (€746MM) divided by average tangible assets, which for Adyen represents total assets (€12,682MM) minus cash and cash equivalents (€11,243MM) and intangible assets (€8MM).

Capital Allocation

Adyen has not paid dividends, repurchased shares or made any material acquisitions since 2018. As a result, cash available to Adyen increased from €124MM on June 30, 2018, to €3,786MM on June 30, 2025. Adyen has retained cash on its balance sheet to maintain a strong credit rating, supporting its embedded finance strategy for platform customers.

Disclosure: I do not hold a position in Adyen. Of the stocks mentioned in this report, I am long Global Payments and Fiserv. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.

People costs include wages and salaries and social securities and pensions costs

I use recurring gross profit for Toast, gross profit for Block and subscription revenue plus merchant gross profit for Shopify

Excluding eBay and Cash App processed volume in each period

The combination of Global Payments’ Merchant business and Worldpay

I don’t believe there’s an obvious catalyst. They continue to grow into their valuation, which seems more reasonable now, but not compelling. The company has been at the lower end of their revenue growth targets the last couple years, which hasn’t helped. Expanding into platforms and scaling up their embedded finance offering (issuing, lending and accounts) is kind of the next leg of growth for them so it’s important they continue to show progress. I think they could slow headcount growth meaningfully. I’m not counting on that, but I think it would be a positive catalyst if it happened.

Great write up, as I just started looking into Adyen this really helped out.

For the last 5yrs, stock price has been pretty bad, this despite a company growing above market rates, with above market margins. What do you think the market is worried about?

I understood the tariff point, but at some point the market should move past that? Especially when we are talking about -2% in demand.

Are there any catalysts in the next 18months that you think could shift the market's view of the company?