Company Overview

Corpay CPAY 0.00%↑ simplifies and enhances payments using proprietary networks and modern systems. Its business is divided into four segments: Vehicle Payments, Corporate Payments, Lodging Payments, and Other. Prior to 2023, Corpay disclosed revenue for Fleet and Tolls, which combined to form Vehicle Payments. Below is my estimate of Corpay’s 2024 revenue with Vehicle Payments separated into two areas: Tolls, Parking, Insurance and Compliance and Fuel and Maintenance.

Vehicle Payments

Corpay offers fueling products to businesses and consumers. Originally focused on fossil fuel transactions for fleets, Corpay now provides solutions to locate, reserve, measure, pay and reimburse for electric vehicle charging.

Using mobile apps and RFID technology, Corpay simplifies driver payments for tolls, parking, insurance, and compliance, including registration, taxes, and fines.

Corporate Payments

Corpay offers a comprehensive solution that streamlines accounts payable for businesses of all sizes, with software to digitize and automate processes, support for all payment types, including check, ACH, and virtual card, and cross-border transaction processing.

Lodging Payments

Corpay offers workforces, airlines and insurance customers access to room nights at below market prices.

Other Payments

Corpay provides a comprehensive gift card solution to retailers and a payroll card program for employers.

Proprietary Networks

Corpay’s competitive advantage stems from its proprietary networks, which connect large consumer and business bases with a critical mass of acceptance points, creating a virtuous adoption cycle. Key Corpay networks include:

A virtual card acceptance network of more than four million vendors for corporate payments.

80,000 fueling stations that accept Corpay’s proprietary fleet cards.

More than 600,000 locations for electric vehicle charging.

7.6 million tag holders transacting at over 400 toll plazas and 2,900 parking garages.

Geography

Corpay generates more than 80% of its revenue from three countries: the United States, United Kingdom and Brazil.

Most of Corpay’s businesses operate in the United States, except tolls, which is exclusive to Brazil. The Lodging segment is primarily limited to the United States.

The primary businesses in Brazil are tolls, parking, insurance, compliance, and fuel.

Corpay’s fuel, including electric vehicle charging, and vehicle payments business operates in the United Kingdom.

Go-To-Market

Corpay distributes its products through direct sales, combining an outside presence and telesales, digital channels, and partnerships.

Corpay collaborates with oil companies, leasing firms, and fueling station brands to offer fleet cards, partnering with British Petroleum, Arco, Speedway, and Casey’s.

The company works with original equipment manufacturers to distribute its electric vehicle charging solution.

Corpay sells toll tags at retail, including manned kiosks and unmanned vending machines in high-traffic locations.

Competition

Although Corpay faces many competitors in each segment, its products' primary alternatives across all businesses are traditional payment methods, including cash, checks, ACH, and general-purpose debit and credit cards.

A Brief Company History

Founded as FLEETCOR Technologies in 2000, the company sold fuel cards to small U.S. fleets using its proprietary Fuelman network.

Initial acquisitions expanded the fuel business internationally and entered lodging payments.

FLEETCOR went public in 2010.

In 2014, the $3.5 billion acquisition of Comdata, the company’s largest, provided exposure to over-the-road trucking fleets and virtual cards.

Since acquiring Comdata, Corpay has invested over $5 billion in acquisitions to diversify away from fuel. With a fuel-agnostic offering, Corpay is positioned to support customers transitioning from internal combustion engines to electric vehicles.

FLEETCOR rebranded to Corpay in 2024. CEO Ron Clarke, serving since 2000, owns about 3% of outstanding shares.

How Corpay Makes Money

Corpay earns:

Transaction, volume, and spread-based fees

Account, card, and subscription fees

Finance fees and

Interest on client funds held

In Vehicle Payments, Corpay generates fees from merchants, cardholders and tagholders. Merchant fees may be fixed, a markup on cost, or a percentage of the purchase amount. Corpay also earns late fees and finance fees.

In Corporate Payments, Corpay earns transaction fees from customers, interchange revenue from vendors accepting virtual card payments, a spread over the wholesale rate for currency exchange in cross-border payments, and interest on client funds held, due to the timing difference between customer withdrawals and vendor disbursements.

In Lodging Payments, Corpay earns the markup between the rate it secures a room for and what it charges customers.

Investment Thesis

Corpay’s modern systems and proprietary networks deliver superior payment experiences compared to legacy providers and traditional methods. Unlike open-ended, anonymous traditional payments, Corpay’s solutions offer control, transparency, and savings.

A fuel payment. A driver can use a general-purpose credit card anytime, anywhere, for anything. With a Corpay fleet card, operators can limit purchases to fuel only at specific locations and times. Corpay offers detailed transaction data, including driver, vehicle mileage, gallons purchased, and price. By directing demand to specific fuel stations, Corpay secures volume-based discounts, passing savings to customers.

A lodging payment. Like its fleet card, Corpay saves customers money by leveraging demand for its network of 45,000 discount hotels, securing deep discounts off public rates, and passing savings to customers.

A toll or parking payment. An RFID tag on a driver's windshield automates payments, saving time for drivers and attendants.

A corporate payment. Corpay automates accounts payable, eliminating manual paper-based processes to save time and reduce errors or fraud. It provides detailed transaction data with payments, aiding accounting reconciliation.

Corpay boosts corporate payments with AvidXchange investment. Corpay grows fastest in corporate payments, its largest market, where its automation software and processing capabilities, including virtual cards and cross-border transactions, outperform narrowly focused competitors. Corpay recently announced it is partnering with TPG to take AvidXchange AVDX 0.00%↑ private for $2.2 billion. AvidXchange specializes in software for accounts payable automation, serving middle market companies. Corpay will invest $500 million for a 33% equity stake, with an option to acquire 100% of AvidXchange in 2028. On a pro-forma basis, Corporate Payments revenue will represent approximately 46% of Corpay’s 2026 revenue.

If Corporate Payments maintains mid-teens or higher organic revenue growth, it will contribute 7% to Corpay's total organic growth, driving Corpay toward double-digit organic revenue growth.

Proven acquisition engine identifies complementary assets with untapped earnings potential. Since 2015, Corpay has invested over $5 billion in acquisitions, building a leading corporate payments business, diversified lodging solutions, vehicle payment systems, and electric vehicle charging products. Corpay boosts acquired companies' earnings by raising prices, adding value, opening adjacent markets, enhancing sales and marketing, and cutting costs. Despite significant acquisition spending, Corpay maintains mid-teens return on average capital.

Risks

Corpay faces the following risks:

About 13% of Corpay’s revenue depends on fuel prices and spreads, the difference between wholesale and retail fuel prices.

Corpay lends money to its customers, exposing the company to credit losses.

Although Corpay has developed an electric vehicle charging solution, uncertainty remains about the impact of the shift to electric vehicles on its traditional fleet card product.

A significant portion of Corpay’s debt is exposed to rising interest rates.

With nearly half its revenue from outside the United States, Corpay faces substantial foreign currency translation risk.

Investment Checklist

Below is an evaluation of Corpay using my Investing Checklist.

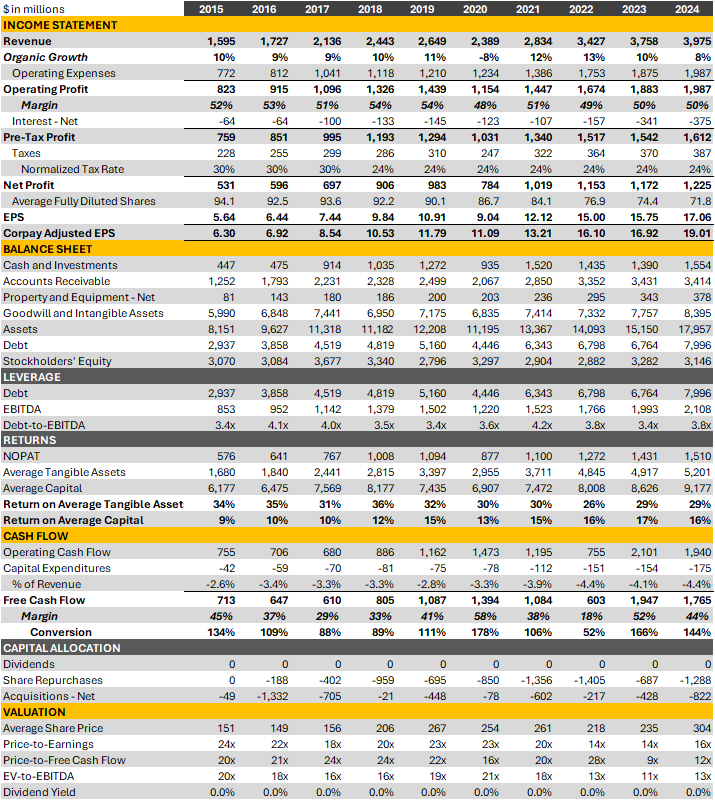

Disclosure. Corpay provides sufficient disclosure for fair value determination. It reports key performance indicators, including fleet transactions, corporate payments spend volume, room nights, the number of tags, tag transactions and parking transactions. Corpay offers an organic revenue growth figure, adjusting for acquisitions, divestitures, fuel prices, fuel price spreads, and foreign currency. Segment and product reporting have evolved with the company’s changing composition and focus. Corpay’s adjusted earnings calculation includes all “special” items, such as stock-based compensation, amortization of acquired intangibles, restructuring, acquisition-related expenses, and gains, losses, and asset impairments. This is the most generous definition of earnings and not a best practice.

Growth. Corpay frequently acquires businesses but maintains steady organic revenue growth, averaging over 8% annually for the past decade. Except in 2020, when organic revenue fell 8%, growth has ranged from 8% to 13%. Corpay serves over 800,000 business clients and 9 million consumers, with no single customer accounting for a meaningful amount of revenue.

Profitability. Corpay’s normalized operating margin1 was 50% in 2024, consistent with its 51% average over the past decade. While margin expansion is ideal, maintaining a high margin while integrating faster-growing businesses is notable. In the last five years, Corpay added back $186 million in legal, restructuring, acquisition, and integration costs. In 2020, it excluded a $90 million loss on a customer receivable from adjusted earnings, a decision I disagree with.

Free Cash Flow. Corpay’s free cash flow has equaled 118% of the company’s net profit2 over the last five years, demonstrating high earnings quality. Stock-based compensation represents less than 3% of revenue.

Financial Health. Corpay’s total debt-to-EBITDA ratio was 3.8x as of March 31, 2025, moderately high. Excluding the securitization facility and factoring in over $1.5 billion in cash, the net debt-to-EBITDA ratio drops to 2.4x, a more comfortable level. Variable-rate debt forms a significant portion of Corpay’s total debt.

Returns. Corpay’s return on average tangible assets averaged 31% over the past decade and was 29% in 2024. Return on average capital was 16% in 2024.

Capital Allocation. Corpay balances capital allocation between share repurchases and acquisitions. Without attractive acquisition opportunities, Corpay increases buyback activity. Over the past decade, Corpay repurchased nearly $8 billion of its shares and spent over $5 billion on acquisitions. In the last five years, it reduced its average diluted share count by 20%. The company does not pay a dividend.

Disclosure: I do not hold a position in Corpay or any other stock mentioned in this article. The article is for informational purposes only and is not a recommendation to buy or sell Corpay or any other stock.

Here is how I define normalized operating profit:

GAAP operating profit + amortization of acquired intangible assets

I do not add back:

Stock-based compensation

Restructuring or

Acquisition-related expenses

Net profit does not add back stock-based compensation, legal, merger, integration, and restructuring costs

You’ve captured the essence of Corpay’s market opportunity beautifully. One risk worth adding is the deceleration in card spend growth within mid-market corporate expenditures, largely driven by merchant resistance to high acceptance costs. While digitization of B2B payments continues to accelerate, ACH is gaining ground and card monetization potential is still constrained by several factors:

- Legacy ERP systems that limit seamless integration for both buyers and suppliers

- Supplier onboarding friction and the complexities of receiving electronic payments, including fees, reconciliation challenges, and varying levels of digital readiness

These are not insurmountable for Corpay—but they’re real barriers that must be addressed through better new payment products, infrastructure and value alignment across buyers and suppliers.