Long Adyen

Refining my Payments exposure

My full report on Adyen published in September 2025:

Actions

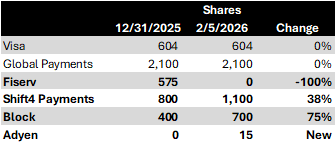

On Tuesday (February 3) I sold my remaining Fiserv shares to fund a starter position in Adyen and add to my holdings in Shift4 Payments and Block. Below are the changes I’ve made to my Payments holdings since the end of last year:

Adyen Thesis

Unlike legacy peers that have cobbled together systems, products, sales and distribution from a long list of acquisitions, Adyen has built a modern payments engine entirely from scratch complete with local acquiring licenses and banking charters to control its own destiny, enabling a merchant to sell anywhere, across any channel, and accept virtually any payment method, all from a single low-cost platform backed by powerful insights derived from Adyen’s extensive data.

For merchants, Adyen delivers more revenue through higher conversion and approval rates and lowers costs by reducing fraud and optimizing acceptance. Even though most enterprise customers still work with multiple processors, Adyen has the unique ability to displace them all, if given the opportunity.

For Adyen, a single platform simplifies and speeds product development and deployment and enables efficient data capture and utilization.

The result is a best-in-class combination of organic growth and profitability for Adyen, rivaled only by Visa and Mastercard:

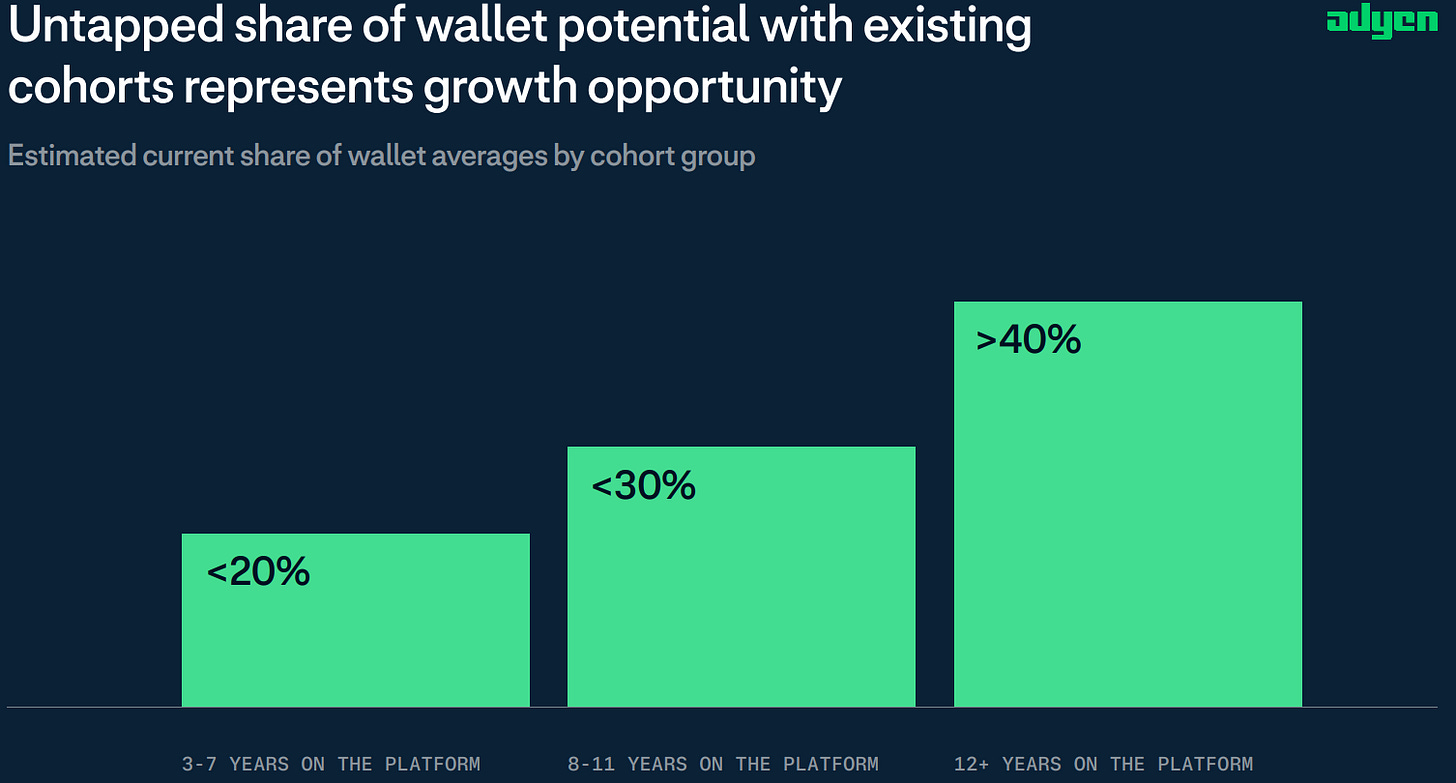

The bulk of Adyen’s growth does not come from adding new logos, but from the lower risk proposition of capturing a greater portion of volume from existing customers, which, on their own, are already expanding at an attractive clip. To achieve this, Adyen entices customers with lower prices for more volume and earns their trust by delivering superior service and performance.

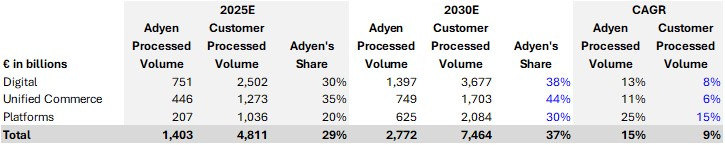

From 2025 to 2030, I believe Adyen can achieve compound annual processed volume growth in the mid-teens from just its existing customer base:

Adyen has moved beyond its original focus of powering digital payments for enterprise customers primarily in Europe, to process in-store and digital transactions for both enterprises and small businesses, through platforms, across the globe, opening new avenues for growth.

A longer-term opportunity for Adyen comes from its embedded finance strategy, which involves issuing cards, extending loans, and offering banking services to attract both platforms and the small businesses they serve.

All in, I have a high level of confidence in Adyen’s ability to achieve mid-to-high teens organic net revenue over the medium-term through growing, and further expanding, with existing customers, adding new customers in new verticals, and thoughtfully monetizing additional products and services, including its embedded finance offerings.

After a significant hiring spree in 2022 and 2023, Adyen’s EBITDA margin dropped from 63% to 47%, only recovering to 52% by 2025. Unlike every one of its peers, Adyen has never undergone a reduction in force. Although I’m not expecting one or investing based on that possibility, I believe Adyen has the capacity to reclaim significantly higher margins over time.

Finally, Adyen’s earnings quality is of the highest order. There are no adjustments for restructuring charges, acquisition costs, or stock-based compensation, which is minimal. Free cash flow is significant, and conversion of net profit is greater than 100%. Adyen carries no debt and had available cash of €3,786 million as of June 30, 2025. Although it has opened the door to inorganic opportunities, Adyen’s preference is to build capabilities internally, allowing it to avoid acquisitions historically.

Valuation

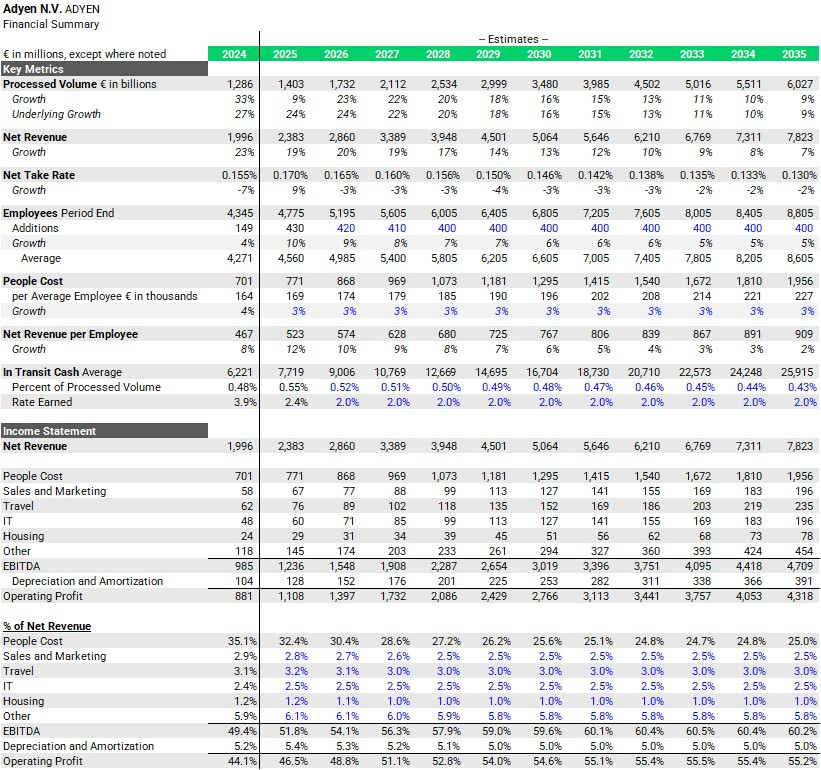

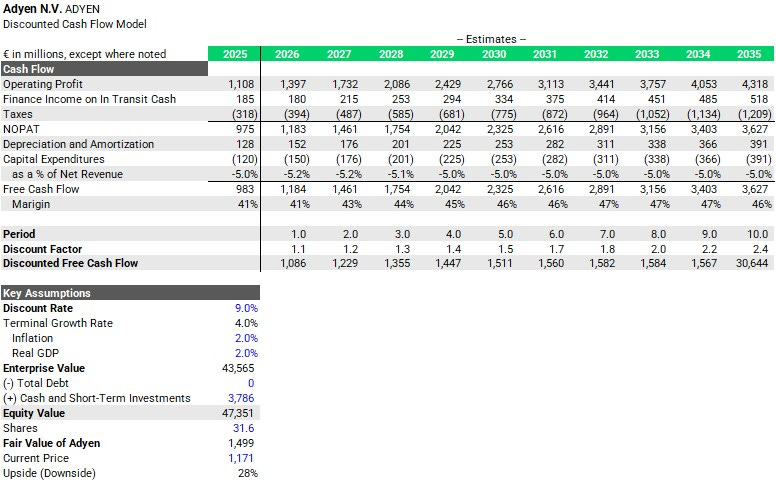

Adyen is a high-quality business, so for me, it always comes down to valuation. Based on what I believe are reasonably prudent assumptions, my fair value for Adyen is about €1,500 per share. Shares trade at a 28% discount, presenting a more-than-reasonable entry point. Below are key assumptions for my financial forecast:

From 2025 to 2030, I estimate Adyen’s processed volume will grow at a 20% compound annual rate with net revenue growing approximately 16%, implying tier-based pricing reduces net revenue growth by 3-4 points annually. I expect Adyen to achieve a 59.6% EBITDA margin by 2030 with people costs falling to less than 26% of net revenue, down from 32% in 2024. I expect Adyen will add 400, or more, employees per year and for costs per employee to rise 3% annually. I model in-transit cash to grow at a slower rate than processed volume (falling from 55 bps of processed volume to 48 bps by 2030) with an average yield of about 2%.

In the out years (2030-2035), I estimate processed volume and net revenue will grow at a compound annual rate of less than 12% and more than 9%, respectively. The slightly reduced spread between processed volume and net revenue growth reflects increased monetization of Adyen’s embedded finance offering. I expect Adyen’s EBITDA margin to reach 60.5% by 2033 and stay relatively flat thereafter with people costs stabilizing at about 25% of net revenue. I assume in-transit cash grows at a slower rate than processed volume (falling from 48 bps of processed volume to 43 bps by 2035) with an average yield of 2%.

For my DCF model, I assume a tax rate of 25%, depreciation and amortization and capital expenditures equal to 5% of net revenue throughout most of my forecast period and a discount rate of 9%, which reflects Adyen’s strong financial position and organic approach to operating the business, which lessens the likelihood of disruptive impacts from major acquisitions:

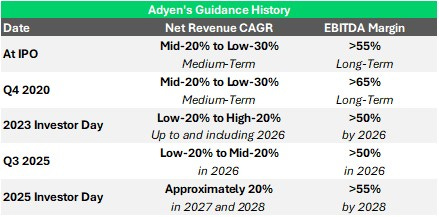

How do my expectations compare with Adyen’s?

For 2026, Adyen expects net revenue growth in the low-to-mid 20% range, which compares to my estimate of 20%. I expect EBITDA margin to expand 2.3 points to 54.1%, which compares to Adyen’s outlook for above 50%.

For 207 and 2028, I estimate net revenue growth of 19% and 17%, respectively, below Adyen’s guidance for approximately 20% growth in each year. By 2028, I expect Adyen’s EBITDA margin to reach nearly 58%, which compares to Adyen’s outlook for above 55%.

How do Adyen’s market-based multiples compare to peers?

On an EV-to-EBITDA basis, Adyen trades at 21.6x my 2026 estimate, which is about in-line with Visa and Mastercard, but at a discount to higher-growth non-network peers Shopify (>61x) and Toast (26.7x). If I add my estimate for finance income on in-transit cash (€180 million) to EBITDA (€1,548 million), Adyen’s EV-to-EBITDA multiple falls to 19.3x.

All prices as of close February 4, 2026:

Risks

The primary risks I see for Adyen are intensifying competition, share of wallet loss, and agentic commerce, with its newness creating more uncertainty than risk. Adyen faces several highly capable competitors, including Stripe and Braintree, which recently announced the ability to process in-store payments for enterprise customers, creating a new competitor in Adyen’s Unified Commerce pillar. Although Adyen has historically processed a growing portion of customer volume, given that most customers work with multiple processors and volume is fluid, it is possible Adyen’s share of wallet could decline, especially if competitors become more aggressive on pricing, as Braintree did a few years ago. Finally, agentic commerce creates new questions about Adyen’s role and economics in the payment value chain. Unlike some competitors, who have put out splashy press releases but nothing else, Adyen appears to be taking a methodical approach to agentic commerce, which remains in its very early stages, consulting with its customers (i.e., merchants) to determine their aspirations, and fears, for the emerging technology. Ultimately, I believe Adyen’s single platform, which enables end-to-end data capture and utilization, will allow Adyen to play one of the most important roles for agentic commerce, promoting trust among consumers and merchants and limiting fraud.

Why I Sold Fiserv

To state the obvious, my investment in Fiserv did not turn out the way I envisioned or hoped. The foundation of Fiserv’s recent success proved to be shaky, at best: an outsized benefit from Argentinian inflation, overly aggressive monetization of products and services, and deferred investments that boosted near-term profitability but eroded service levels and slowed product development. Even though I believe Fiserv is undervalued, perhaps significantly so, there is an element of uncertainty that will follow the company, and stock, as it attempts to reaccelerate organic revenue growth to the mid-single digits by 2027. For me, the biggest question mark is on the Financial Solutions segment, where recent commentary suggests core banking platform consolidations risk disrupting a critical customer base and other products face secular decline, calling into question the long-term growth potential and margin profile for the business.

At the end of the day, I believe Adyen, Block and Shift4 offer better use of my capital than Fiserv, with the added benefit of the Fiserv sale creating significant tax losses to offset future gains, if they ever happen…

For more information on Block and Shift4, please see the links below:

Shift4 Payments: What's It Worth?

Shift4 Payments: Positioned to win in hospitality

As always, thank you for reading, and if you’ve enjoyed this, please consider sharing, liking, commenting or subscribing!

Disclosure: Of the companies mentioned in this report, as of February 5, 2025, I am long Visa, Global Payments, Shift4 Payments, Block and Adyen. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.

Fantastic next gen payment processor. I prefer to add around their earning days where price swung violently though. Thank you again and enjoy your write up!

Hi, Any thoughts on Adyen after earnings.