Shopify Inc. (SHOP)

A juggernaut with the price to match

Shopify is No. 3 on my list of the Top 10 Businesses in Payments and FinTech.

Investment Brief

Shopify is a rare breed. Like other FinTechs, Shopify soared to incredible heights during the pandemic, fell back to earth, and then regrouped. But unlike peers, Shopify is knocking on the door of new all-time highs…

And recapturing lofty valuations:

So, how did they do it? There’s no doubt Shopify is a generational company. They obsess over customer success and deliver exceptional features, on their own and with the help of world-class partners. Where PayPal once dominated by enabling payments for small online sellers, Shopify is asserting control as the go-to all-in-one commerce platform. But Shopify’s not stopping there. They’re moving upmarket, expanding in-store, and widening their global presence. That’s not where the story ends though. Shopify’s return to glory can be best described as a series of decisions that reversed mistakes, accelerated growth, and super-charged profitability.

Glory days. Growing rapidly beforehand, the pandemic launched Shopify into another stratosphere. From 2019 to 2021, Shopify’s GMV, revenue and gross profit increased 186%, 192% and 186%, respectively. Like other FinTech high-flyers, Shopify’s hyper-growth led to largesse, and Shopify’s employee base doubled over the same time. But the market took it in stride. The paradigm had shifted. The accelerated pace of e-commerce penetration was the new normal. Good times were here to stay, and fat profits were just around the corner.

All things to all merchants. In 2019, Shopify launched the Shopify Fulfillment Network, or SFN, and bolstered its capabilities later in the year with the $450 million acquisition of 6 River Systems, a fulfillment software and robotics provider. Shopify doubled down with the 2022 acquisition of Deliverr, a third-party logistics firm, for $2.1 billion. Shopify had gone all-in on logistics, promising affordable next- or two-day delivery for 90% of their U.S.-based merchants. Where Shopify saw logistics as table-stakes, the market saw it as an expensive foray that would bring them in direct competition with Amazon. In the three trading days following the Deliverr acquisition announcement, shares of Shopify fell 30%.

The first cut is the deepest. On July 26, 2022, CEO Tobi Lutke penned a letter to Shopify employees admitting the bet they had made—that e-commerce channel mix “would permanently leap ahead by 5 or even 10 years”—had been wrong. The result: Shopify was laying off 10% of its workforce. But the market was far ahead of Shopify: prior to the announcement, shares of Shopify had fallen 78% since reaching their all-time high the previous fall. Despite entering 2022 with a market cap of more than $175 billion, Shopify would go on to lose $729 million1 over the next five quarters.

Pricing power unlocked. Shopify took additional steps to restore profitability, following the initial layoffs, by announcing on January 24, 2023, a price increase for standard subscription plans of about 33%, on average, the first in 12 years. The changes took effect immediately for new merchants, with a three-month grace period for existing ones. From Q1 2023, the last quarter before the increase fully took effect, until Q1 2024, Shopify’s monthly recurring subscription revenue increased 32%, with Shopify noting “more robust retention” than anticipated following the price increases, providing evidence of the company’s pricing power2.

A massive one-two punch. The most significant day for Shopify was May 4, 2023, when it announced the sale of its logistics business to Flexport and a further 20% staff reduction. The decisions were crucial, but Shopify’s swift action was most impressive. Less than one year after acquiring Deliverr, Shopify pivoted, admitting that “building logistics infrastructure is a side quest” detracting from its main quest “to make commerce simpler, easier, more democratized, participatory, and common.” Sensing the moment’s importance, investors boosted Shopify’s shares nearly 40% in the three trading days following the announcement.

Shopify and AI. Shopify effectively uses artificial intelligence (AI) company-wide, embedding it internally to optimize marketing, reduce fraud and accelerate feature development, while also integrating it into its commerce platform. For merchants, Sidekick offers strategic support, and Shopify Magic generates website content and designs. Catalog, Shopify’s latest AI-inspired feature, enables AI shopping assistants to access all products sold by Shopify’s merchants from a single API. The Shopify and ChatGPT partnership announced recently will allow ChatGPT users to discover and instantly purchase products from Shopify merchants within the chat.

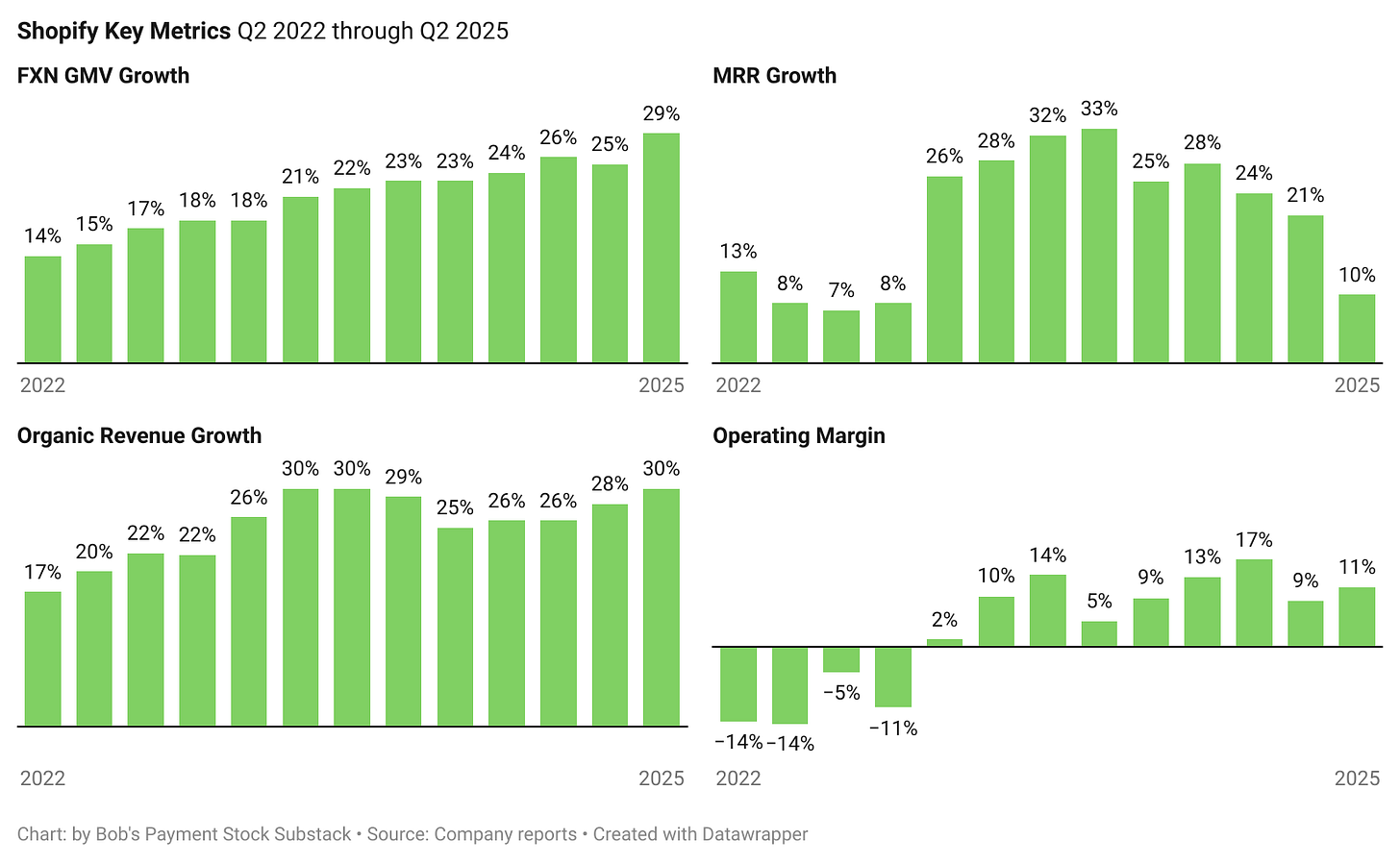

The results have been impressive. Since Shopify’s transformation began, GMV growth more than doubled, organic revenue growth hit 30% last quarter, up from 17%, and operating margin rose to 13% over the past year, up from -4.5%.

But is Shopify worth it? I believe there can be great—even exceptional—businesses that have unattractive stock prices. That’s the case with Shopify, in my opinion. Even though Shopify’s growth is better than peers, it is not demonstrably so. In fact, in 2026, Shopify and Toast are expected to achieve 24% gross profit growth, yet Shopify’s EV-to-EBITDA multiple is over twice Toast’s.

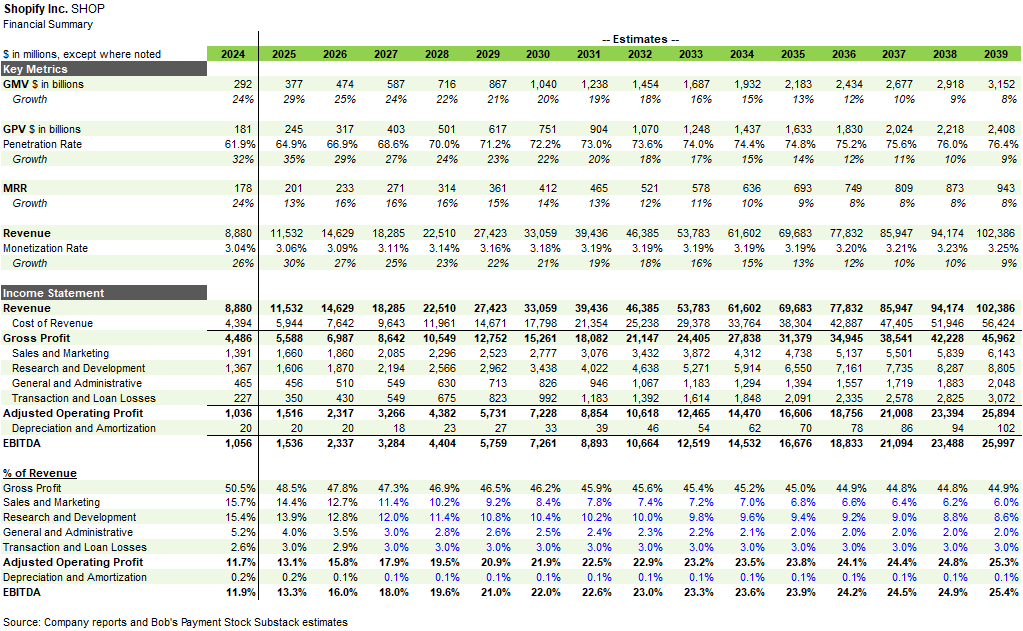

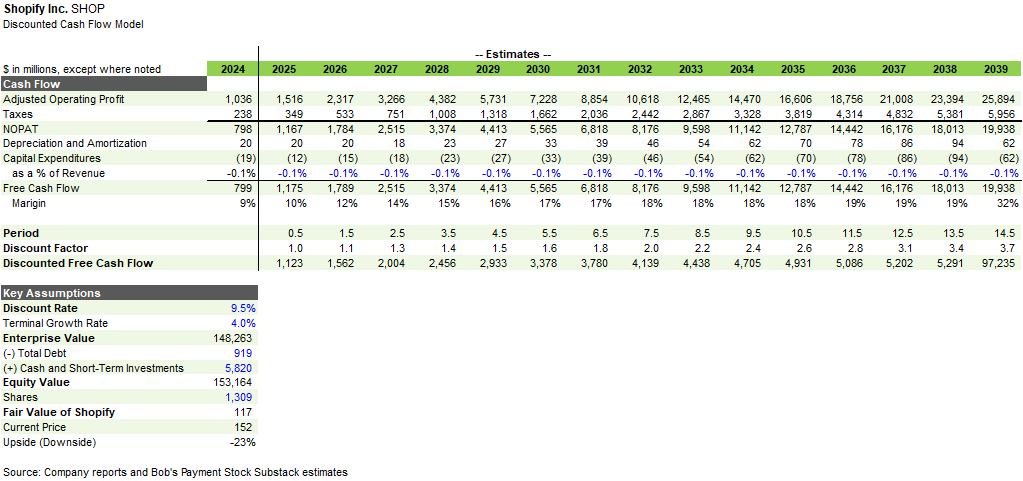

Even under aggressive assumptions, my fair value for Shopify is only $117, nearly a quarter below the company’s current price. To account for Shopify’s unique growth profile, I employ a three-stage DCF model. Over my 15-year forecast period, revenue and operating profit grows at a compound annual rate of 18% and 24%, respectively. By 2039, my model assumes Shopify will generate almost $3.2 trillion of GMV, up >10x vs. 2024, reach a monetization rate3 of 3.25%, up from 3.04% in 2024, and achieve an operating margin of more than 25%. While a 25% operating margin may seem unimpressive, as a percentage of gross profit, it would be more than 56%.

Could I be too conservative? It’s hard to believe so, but if I am, here’s where I think it’s possible:

The attachment of Shopify Payments could be higher. I assume an attach rate exceeding 76% by 2039, up from 62% in 2024. It’s possible this could be higher, but some markets may never adopt Payments, and as the company moves upmarket, some merchants may prefer other processors.

MRR growth could be more significant. I assume a high single-digit annual growth rate in Shopify’s merchant numbers and low-to-mid single-digit growth in revenue per merchant, as more merchants choose higher-priced subscriptions and subscription prices rise. This may be conservative if Shopify leverages its pricing power to a greater degree.

Am I underselling Shopify’s advertising potential? Although I prefer not to base investment decisions on personal experiences, the Shop App has been a terrific resource for finding items, including those on sale. I believe Shopify can leverage this platform to generate higher-margin advertising revenue. While I account for this through increased monetization of GMV, is my estimate too conservative?

Margins could be even better. If a higher mix of subscription fees, greater Payments penetration, and more advertising revenue boosts Shopify’s GMV monetization rate, Shopify’s operating margin would likely exceed my current assumption.

Risks

Shopify took dramatic steps to boost profitability. Future opportunities are likely to be more limited. Within 10 months, from July 2022 to May 2023, Shopify reduced its staff by one-third, raised prices (on its standard plans) by one-third, and sold its less profitable logistics business, causing a major inflection in profitability. This level of shock and awe is likely not repeatable. Therefore, while meaningful long-term opportunities exist, annual margin expansion should be more measured moving forward.

Shopify’s move upmarket and in-store exposes it to less attractive markets and introduces additional competitors. Selling a software-powered commerce platform combined with payments to small online businesses is the most lucrative part of the Payments ecosystem. While expansion among enterprise clients and in-store presents additional growth opportunities for Shopify, the economics will be less attractive, and Shopify will face additional and heightened competition.

Most of Shopify’s merchants are selling discretionary items. Apparel, accessories, and home decor significantly contribute to Shopify’s GMV. In a recession, consumers may reduce spending on these items, slowing Shopify’s growth. Additionally, the company’s reliance on small and mid-sized businesses could lead to challenges, as more may fail and fewer may start during an economic downturn.

Shopify takes a long-term view, which can sometimes impact the short-term. Shopify bills itself as a ‘100-year’ company, emphasizing a willingness to invest in order to create durable growth. While this is the right strategy, it can sometimes lead to slower profit growth over the near-term, which can be disruptive to the company’s high valuation. However, Shopify’s willingness to quickly change course on logistics should reassure investors that management can balance long-term growth with short-term profits.

Renewed competition from PayPal. I’ve always lamented PayPal’s reluctance to pursue a commerce platform for small and mid-sized businesses. Currently, PayPal is focused on boosting consumer engagement on its two-sided network, hoping increased activity will sustain its relevance with merchants. I believe PayPal should shift strategy and develop or acquire tools to help merchants run and grow their business. If they do, it could potentially slow Shopify’s gains in this lucrative segment. But I’m not holding my breath.

The Numbers

My fair value for Shopify is $117. However, to invest in Shopify, I would prefer a large margin of safety, given my belief believe the assumptions that drive my fair value are firmly on the aggressive side. Key assumptions include:

GMV: Over my 15-year forecast, I assume Shopify’s GMV will grow at a 17% compound annual rate, reaching $3.152 trillion by 2039. In 2025, I estimate global e-commerce retail sales, excluding China, will be about $3.9 trillion, implying a 9-10% market share for Shopify. If this $3.9 trillion grows at an 8% compound annual rate over 15 years—aggressive, in my view—it would reach $11.4 trillion by 2039, with Shopify’s $3.152 trillion of GMV equating to a 28% market share.

GPV: I assume Shopify Payments’ penetration rate rises from 62% in 2024 to over 76% by 2039, with GPV growing at a 19% compound annual rate over my 15-year forecast. As I said previously, I believe some markets may never adopt Shopify Payments, and as Shopify moves upmarket, some merchants may prefer other processors, limiting the potential penetration rate for Shopify Payments.

Merchant Solutions: I forecast Merchant Solutions revenue and gross profit to grow at a 19% compound annual rate over my 15-year forecast, matching GPV growth. Although I expect Shopify Payments’ gross take rate to decline as more volume comes from larger businesses, enterprise customers, and in-store sales, Shopify will likely offset this, to some extent, by negotiating better terms with network and processing partners. Additionally, I believe other higher-margin Merchant Solutions revenue will grow attractively, stabilizing the segment’s gross margin.

Subscription Solutions: I assume Subscription Solutions revenue grows at a 14% compound annual rate, outpacing MRR growth of 12%, over my 15-year forecast. MRR estimates assume high single-digit annual merchant growth and low-to-mid single-digit revenue per merchant growth, as more merchants opt for higher-priced subscriptions and prices rise. Faster growth in variable platform fees, reserved for Shopify Plus merchants, accounts for the difference between revenue and MRR growth. I model Subscription Solutions gross margin remaining steady in the low-80% range.

Gross Profit: My assumptions yield a compound annual consolidated gross profit growth rate of 17% over my 15-year forecast, with the margin declining from 50.5% in 2024 to 44.9% in 2039, due to a growing share of lower-margin Merchant Solutions revenue.

Operating Profit: Over my 15-year forecast, I assume Shopify’s operating margin expands to 25.3% by 2039, from 11.7% in 2024, yielding a 24% compound annual operating profit growth rate. As a percentage of gross profit, my 2039 operating profit estimate implies a margin exceeding 56%, up from 23% in 2024.

For my DCF model, I assume:

A tax rate of 23%

Very low capital intensity for Shopify, with depreciation and amortization and capital expenditures equaling only 0.1% of revenue throughout my forecast period and

A discount rate of 9.5%, which reflects Shopify’s strong competitive position in e-commerce, pristine balance sheet, and primarily organic approach to operating the business. With a discount rate of 9%, my fair value estimate would rise to $130, still below the company’s current share price.

Company Overview

Started as a website builder for small businesses and individuals to sell online direct-to-consumer (DTC), Shopify has transformed into an all-in-one cloud-based commerce platform for businesses of all sizes. Key features of the company’s commerce platform include:

Multi-channel storefronts: Shopify enables merchants to sell online, through a branded mobile app, on social media platforms and marketplaces, in-store, and now, within ChatGPT.

Global: Shopify provides tools to create localized shopping experiences, simplifying international expansion and increasing cross-border sales for its merchants.

Payments: In partnership with Stripe, Shopify offers integrated payment processing to merchants in its major markets. Overall, 62% of gross merchandise volume, or GMV, was processed through Shopify Payments during 2024. Where available, penetration is high. At the end of 2024, Shopify Payments was in 23 countries. In Q1 2025, an additional 16 countries were added, bringing the total to 39.

Financial Services: Shopify offers banking and finance services to its merchants, including Shopify Capital loans, Shopify Balance, a business account for faster payouts, Shopify Credit, a business credit card, a bill payment solution powered by Melio, and Shopify Tax for sales tax calculation, collection and reporting.

Business Management: Shopify offers various tools for merchants to run and grow their business, including marketing campaigns, inventory management and shipping.

Apps: For additional or advanced features not available from Shopify, the company offers a store for third-party developers to create apps that integrate into Shopify’s commerce platform.

AI Tools: Shopify’s commerce platform uses AI to advise merchants, streamline customer support, enhance website design, and create content for product descriptions and marketing campaigns.

Shopify offers four subscription tiers for its commerce platform: Basic, Grow, Advanced, and Plus, the most robust package, typically suitable for larger, more complex merchants. Shopify offers monthly and annual pricing for its standard plans and monthly and multi-year pricing for Shopify Plus:

In addition to a commerce platform for merchants, Shopify offers the Shop App, a digital shopping assistant and wallet for consumers, and Shop Pay, an accelerated checkout feature for merchants, including those that do not utilize the Shopify commerce platform. The Shop App lets consumers discover products sold by Shopify’s merchants, store payment credentials for Shop Pay transactions, enabling seamless checkout, earn rewards on purchases, track shipping, and access Affirm-powered installment loans. At the end of 2024, Shopify reported “hundreds of millions” of Shop Pay users, with Shop Pay accounting for 38% of gross payment volume in 2024, implying $69 billion.

How Does Shopify Make Money?

The two primary sources of Shopify’s revenue are: (1) processing and currency conversion fees from Shopify Payments; and (2) subscription fees:

Additional sources of Merchant Solutions revenue include transaction fees from merchants—assessed on GMV—not using Shopify Payments, interest from Shopify Capital loans, referral fees from third parties, and terminal sales.

Additional sources of Subscription Solutions revenue include commissions from purchases made in Shopify’s app store, variable platform fees, typically reserved for larger merchants in lieu of subscription fees and assessed on GMV, specialized storefront theme fees, and domain name registration fees.

Payment revenue carries the lowest gross margin. I estimate Shopify Payments revenue has a gross margin in the low-30% range, reflecting a gross take rate of about 2.8%, interchange costs ranging from 1.8-1.9% (two-thirds of transactions are credit, and one-third is debit), and a small amount of additional processing and network fees. This implies other Merchant Solutions revenue generates gross margins in the upper-60% range.

Go-To-Market

Shopify uses a dual approach to acquire merchants: for individuals and small businesses, it employs marketing, digital outreach, a vast network of referral partners and free trials and special promotional pricing. For larger merchants and enterprise customers, Shopify relies on a direct sales force.

Geography

About two-thirds of Shopify’s revenue comes from the United States, but its share has decreased slightly over time, while the Europe, Middle East, and Africa (EMEA) region’s share has increased.

Investment Checklist

Below is an evaluation of Shopify using my Investing Checklist:

Disclosure

Shopify provides adequate disclosure, consistently reporting gross merchandise and payment volume (GMV and GPV), and monthly recurring revenue (MRR), a key indicator of future subscription fees. The company selectively discloses other metrics, such as merchant numbers and revenue and GMV from newer verticals like offline, international, B2B, and Shop Pay. Disclosure has declined slightly over time, in my opinion. Though not ideal, sufficient information is provided to estimate the company’s fair value. Shopify reports operating and net profit on a non-GAAP basis, excluding non-recurring items, acquisition-related costs, and stock-based compensation.

Growth

From 2019 to 2024, Shopify’s GMV, GPV, MRR, and revenue grew at compound annual rates of 37%, 48%, 27%, and 41%, respectively.

Shopify demonstrates favorable growth characteristics:

No single customer accounts for a significant portion of Shopify’s revenue due to its large customer base of entrepreneurs and small to mid-sized businesses

Growth is driven by merchant growth, increased adoption of Shopify Payments, and higher-value subscriptions. While pricing significantly impacted growth recently, consistent large increases are unlikely, though pricing should contribute to long-term growth

Shopify relies on partnerships or small, tuck-in acquisitions to address feature or service gaps, rather than depending on acquisitions for growth

Profitability

In 2024, Shopify generated $1,036 million in operating profit, an 11.7% margin on revenue, a significant improvement from the $557 million operating loss in 2022. However, Shopify’s revenue is misleading, as it reflects the gross fees charged to the merchant for payment processing, even though there’s an assumption built-in for interchange, network, and processing fees. On a gross profit basis, which is how some other FinTechs report, Shopify’s operating margin was 23% in 2024. Over time, I believe attractive gross profit growth combined with moderate headcount expansion will drive significant expansion in the company’s operating margin, which is expected to reach more than 56%—on a gross profit basis—by 2039.

Free Cash Flow

Over the past year, Shopify generated $1,813 million in GAAP free cash flow, representing 18% of revenue and nearly 37% of gross profit. Excluding stock-based compensation, Shopify’s free cash flow was $1,371 million over the last twelve months, just 0.7% of the company’s market cap.

Financial Health

As of June 30, 2025, Shopify had $5.8 billion of cash and equivalents and $919 million of debt in the form of senior convertible notes.

Returns

Shopify’s asset-light model produces attractive returns. During 2025, I estimate Shopify will generate a return on intangible assets of approximately 50%.

Capital Allocation

Shopify retains most of its excess capital as cash and marketable securities. The company pays no dividends, has never repurchased shares, and, apart from acquiring 6 River Systems and Deliverr, prefers smaller tuck-in acquisitions over large ones.

Disclosure: I do not hold a position in Shopify or any of the other stocks mentioned in this article. This report is for informational purposes only and is not a recommendation to buy or sell any stock. Finally, while I rely on the information in this report to guide my investment decisions, you should not, because I cannot guarantee its accuracy.

From Q1 2022 through Q1 2023, Shopify reported negative operating profit of $729 million. Operating profit and operating margin, cited throughout this report, adds-back one-time items but excludes stock-based compensation.

The company made an adjustment to the pricing of its Shopify Plus subscription plans at the beginning of 2024. While this had a favorable impact on MRR growth, it was not as large as the impact from the 2023 pricing changes for standard plans.

Monetization rate equals revenue divided by GMV.